In today’s hyper-connected world, access to mobile data has become a necessity for billions of people, powering everything from work and education to entertainment and communication. However, the cost of mobile data varies significantly across the globe, influencing digital accessibility and economic opportunities. A closer look at these differences helps us understand how geography, infrastructure, and market conditions shape the global digital landscape.

TL;DR

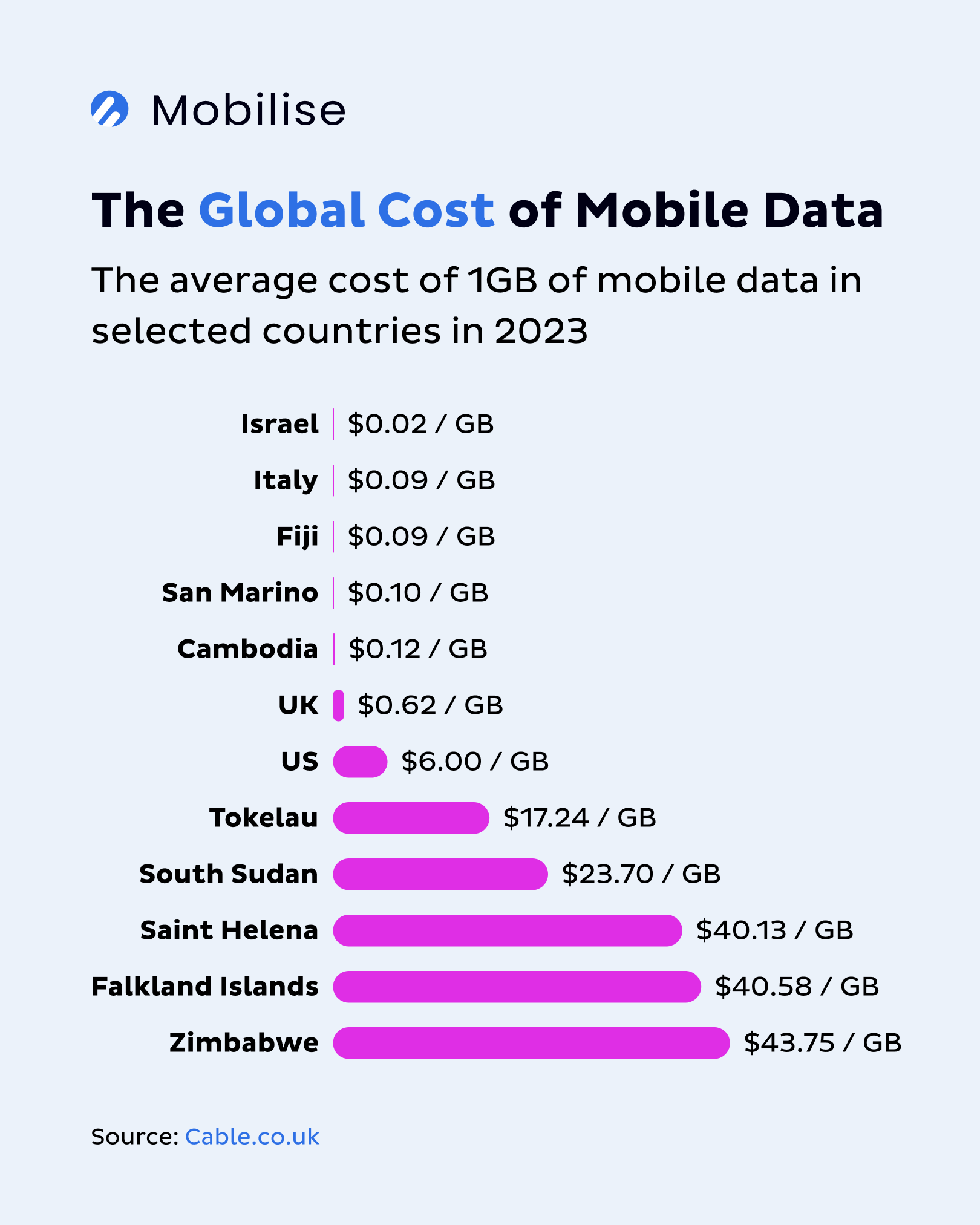

- What’s the worldwide cost of mobile data? The cost of 1GB of mobile data varies globally, from as low as $0.02 in Israel to as high as $43.75 in Zimbabwe.

- Which countries have the lowest cost of mobile data? Countries with advanced infrastructure and competitive telecom markets, like Israel and Italy, tend to have the lowest data prices.

- Which countries have the highest cost of mobile data? Remote and less developed regions face the highest costs due to limited infrastructure and less competition, particularly in Africa and Pacific island nations.

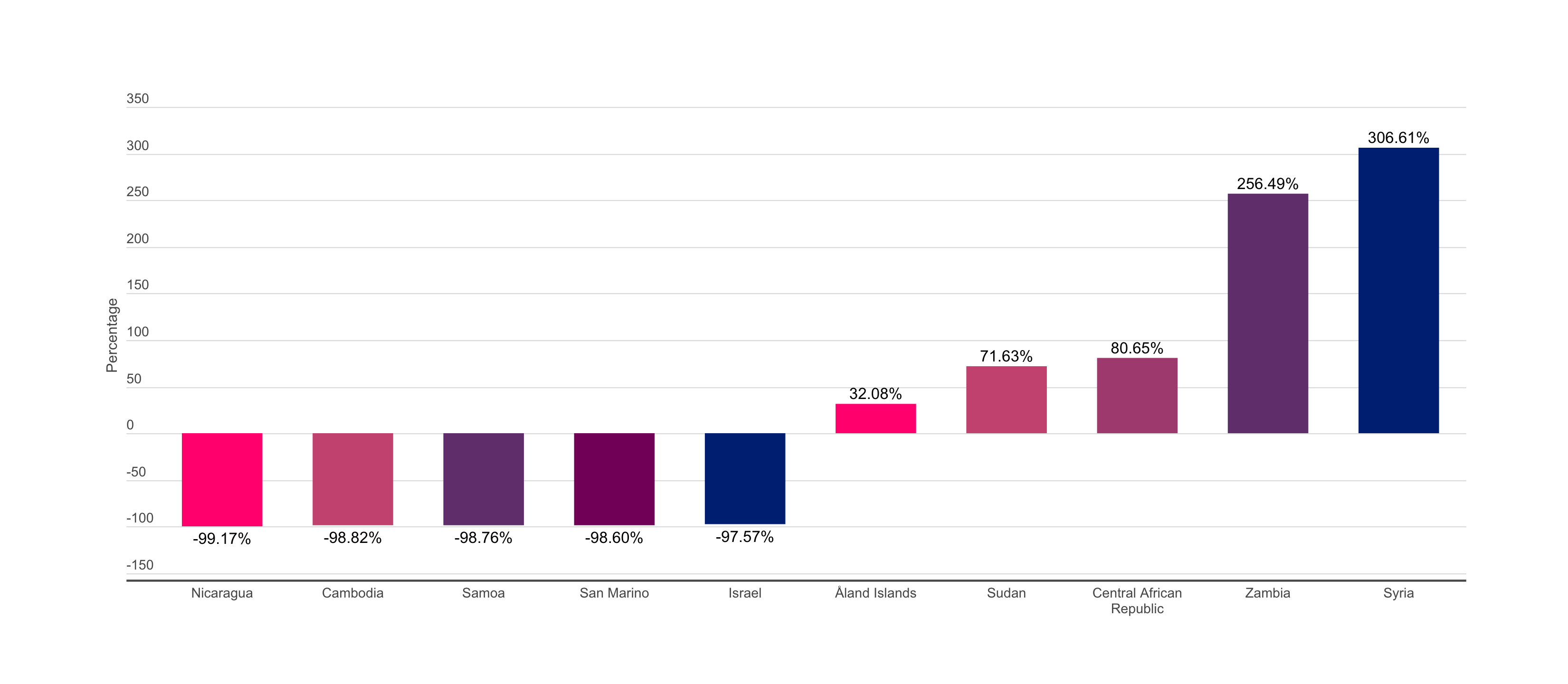

- How has the cost of mobile data changed over time? The global average price of 1GB has decreased over the past few years, but significant disparities remain between the cheapest and most expensive regions.

- What factors influence the cost of mobile data? Factors influencing data costs include infrastructure quality, market competition, government regulations, and the size of the user base.

- What’s the future cost of mobile data? Future trends like 5G expansion and improved infrastructure could help lower data costs in many regions, potentially reducing the digital divide.

Why Does the Cost of Mobile Data Vary?

Several factors determine the cost of mobile data, making it cheaper in some regions while more expensive in others:

- Infrastructure and Network Coverage – Advanced networks like 4G and 5G reduce data costs by improving efficiency in countries like Israel and Italy. In contrast, countries with older networks or vast rural areas face higher prices due to higher infrastructure costs.

- Market Competition – More telecom operators create competition, driving down prices. Markets like India benefit from price wars among providers, whereas monopolistic markets often see higher costs. The presence of MVNOs can also lower prices by offering competitive plans.

- Government Policies – Licensing fees and regulations impact data pricing. High spectrum fees or economic sanctions can increase costs, while policies promoting network sharing and price caps can make data more affordable.

- Demand and User Base – Large populations with high demand, such as India, allow providers to spread infrastructure costs, reducing prices. Demand drives competition in regions reliant on mobile data due to limited broadband options, though infrastructure challenges can keep prices higher.

Understanding these dynamics helps explain why some regions enjoy low data costs while others face higher prices due to economic or logistical challenges.

The Global Landscape: Most Expensive vs. Cheapest Countries

Source: Cable.co.uk

Source: Cable.co.uk

The global pricing of mobile data reveals a striking disparity between countries with the most affordable and expensive rates. These variations are influenced by factors such as market competition, network infrastructure, and economic conditions. Below, we explore these differences in more detail, highlighting the regions and countries that stand out at either end of the spectrum.

Cheapest Countries for Mobile Data

The countries offering the lowest prices for 1GB of mobile data tend to have competitive markets, robust infrastructure, and high demand for data services. These markets often feature multiple providers, fostering a competitive environment that drives down prices.

Israel ($0.02 per GB)

Israel has consistently ranked as the cheapest country for mobile data. This is primarily due to its well-established telecom sector, where multiple operators compete aggressively for customers. The widespread availability of 4G and 5G networks means providers can offer large data packages at very low prices. Furthermore, Israel’s high smartphone penetration, with over three-quarters of the population owning smartphones, creates a market where large data allowances are standard.

Italy ($0.09 per GB)

Italy’s telecom market is characterised by major operators and smaller, agile MVNOs (Mobile Virtual Network Operators). The competition among these providers results in lower prices for consumers. Additionally, Italy boasts extensive 5G coverage, reaching approximately 95% of the population, which allows operators to deliver data more efficiently. MVNOs offering competitive deals further contribute to Italy’s position as one of the cheapest countries for mobile data.

Fiji ($0.09 per GB)

Despite being a remote island nation, Fiji offers some of the world’s lowest mobile data prices. This is due to two major network operators covering the entire country, ensuring broad access to both 4G and 5G services. The relatively small population means that competition for customers remains intense, encouraging providers to keep prices low to maintain market share.

San Marino ($0.10 per GB)

San Marino, a small European microstate surrounded by Italy, benefits from its proximity to a highly competitive market. Italian operator TIM launched its first 5G network, providing 100% coverage within the country. This small market benefits from neighbouring Italy’s infrastructure and market dynamics, allowing it to offer very low data prices.

Cambodia ($0.12 per GB)

Cambodia’s position among the cheapest data markets can be attributed to a competitive telecom sector with several active operators. This competition and a growing demand for mobile internet have helped drive down prices. The country is also seeing improvements in its 4G infrastructure, which contributes to the availability of cost-effective data packages.

Most Expensive Countries for Mobile Data

At the other end of the spectrum, countries with the highest data costs often face significant challenges, such as geographic isolation, underdeveloped infrastructure, and limited competition. These factors drive up the costs for both providers and consumers. Here are the five most expensive countries for 1GB of mobile data:

Zimbabwe ($43.75 per GB)

Zimbabwe is the most expensive country in the world for mobile data. This is mainly due to economic instability, hyperinflation, and a struggling telecom sector. Network providers in Zimbabwe face high operational costs and challenges in maintaining infrastructure, especially in rural areas. The economic situation also affects the affordability of mobile services for consumers, leading to a significant disparity between the cost of data and average incomes.

Falkland Islands ($40.58 per GB)

As a remote British Overseas Territory in the South Atlantic, the Falkland Islands faces high logistical challenges in establishing and maintaining telecommunications infrastructure. The small population size and lack of competition mean providers must spread infrastructure costs over a smaller user base, increasing the price per gigabyte. Additionally, the reliance on satellite connections further increases costs.

Saint Helena ($40.13 per GB)

Like the Falkland Islands, Saint Helena is a remote island facing significant connectivity challenges. The island relies heavily on satellite links, which are more expensive than undersea cables used by other regions. With a small population and only one telecom provider, there is little competitive pressure to lower prices, resulting in high costs for data services.

South Sudan ($23.70 per GB)

South Sudan’s high mobile data costs reflect its economic and political instability. The country’s telecom infrastructure is underdeveloped, and operators face significant challenges, including security concerns, lack of investment, and logistical difficulties in expanding network coverage. The limited competition among providers further exacerbates the high prices, prohibiting data access for many citizens.

Tokelau ($17.24 per GB)

Tokelau is a highly remote group of small Pacific atolls, which poses challenges for maintaining telecommunications infrastructure. The country’s reliance on satellite connections and its very small population lead to high operational costs for single telecom providers. Data prices remain high with little to no competition, reflecting connectivity challenges in such isolated regions.

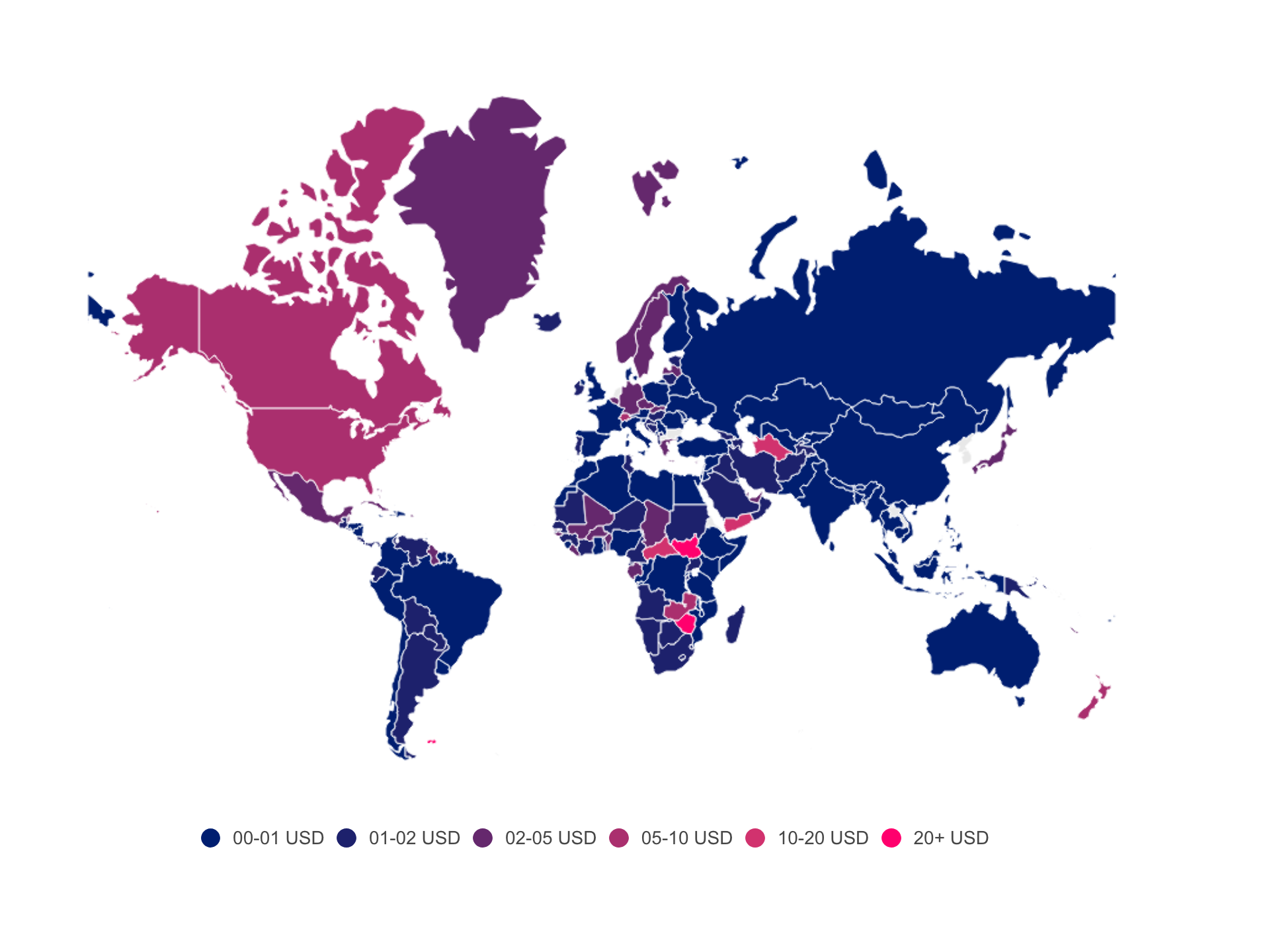

Regional Trends in Mobile Data Pricing

These differences in pricing are also reflected across broader regional trends:

- Sub-Saharan Africa is home to some of the cheapest and most expensive mobile data markets. While countries like Malawi offer data for under $0.40 per GB, others, such as Zimbabwe and South Sudan, have prices exceeding $20 per GB. This disparity is often due to differences in economic conditions, competition, and the extent of network coverage.

- Asia has many of the world’s cheapest markets, including countries like India and Cambodia. Competitive markets and large populations drive down prices. However, more developed nations such as Japan and South Korea tend to have higher prices, influenced by advanced infrastructure and higher costs of maintaining 5G networks.

- Pacific Island Nations frequently face high data prices due to their geographic isolation, small populations, and dependence on satellite connectivity. This makes it difficult for providers to achieve economies of scale, as seen in places like the Falkland Islands and Tokelau.

- Thanks to robust infrastructure and high competition among operators, Europe generally offers some of the most affordable data, especially in countries like Italy and Moldova. Not only that, but according to the UNTWO, Europe is the world’s most visited region, accounting for 50% of global tourist arrivals, allowing for more affordable data costs to provide affordable internet for travellers. However, smaller European markets with less competition, such as the Faroe Islands, often see higher prices.

Source: Cable.co.uk

Source: Cable.co.uk

Why the Disparity Matters

The significant gap between the cheapest and most expensive data markets affects more than just consumer costs—it influences digital inclusion, economic growth, and social development. In countries with high data costs, access to digital services can be restricted, widening the digital divide and limiting opportunities for education, business, and social connectivity. Conversely, affordable data can drive economic growth, increase digital adoption, and empower citizens to participate fully in the digital economy.

Understanding these global trends helps shed light on how different regions adapt to the growing demand for mobile data and their unique challenges. Addressing these disparities as the world moves toward more digital connectivity is crucial for ensuring equitable access to the Internet and the opportunities it provides.

Why Some Countries Have Cheaper Mobile Data

India: A Competitive Market with a Digital Focus

India offers some of the lowest mobile data prices globally, driven by intense competition, a large user base, and government initiatives. The entry of Reliance Jio in 2016 sparked a price war, forcing competitors like Bharti Airtel and Vodafone Idea to lower rates and offer larger data allowances. This competition, coupled with a population exceeding 1.4 billion, allows providers to spread costs across a vast user base. Government initiatives like “Digital India” and reduced spectrum fees have further incentivised operators to expand 4G and 5G networks, making data accessible even in rural areas.

Europe: Regulation and Innovation

European countries benefit from a regulated telecom market and collaborative practices, which help maintain low data prices. Stringent EU competition laws prevent monopolies, allowing smaller providers and MVNOs to thrive. Initiatives like “Roam Like at Home” encourage competitive pricing and ensure data plans remain affordable across borders. Europe’s high 4G and 5G penetration also supports cost-effective data delivery, while strong consumer protections ensure transparency and fair pricing for users.

Why Some Countries Have Expensive Mobile Data

African Countries

In many African nations, mobile data is costly due to a combination of infrastructure challenges, economic factors, and market dynamics. Building and maintaining network infrastructure, particularly in remote or rural areas, requires substantial investment, and many countries lack the capital needed for widespread 4G or 5G deployment. High licensing fees for spectrum and regulatory costs add further financial burdens to telecom providers, often passed on to consumers.

Additionally, many African countries rely heavily on imported technology, including network equipment and devices, leading to higher costs due to tariffs and shipping fees. The smaller user bases in these countries also mean that providers cannot benefit from economies of scale. With fewer subscribers to share the costs, the price per user remains high, making mobile data more expensive across the continent.

Isolated Regions

Geographically isolated areas like Bermuda and the Caribbean islands face high mobile data costs, mainly due to their location and small markets. The physical isolation of these regions means that establishing network infrastructure is particularly challenging and expensive. Undersea fibre-optic cables, often used for high-speed internet, are costly to lay and maintain. In many cases, islands must rely on less efficient satellite connections, which further increases costs. Additionally, importing the necessary technology and equipment comes with high shipping fees and import tariffs, adding to the overall expense of network deployment. With small populations, these regions struggle to spread these fixed infrastructure costs over a broad user base, which drives up the per-user costs of mobile data. Limited competition among providers further exacerbates the issue, as a lack of competitive pressure allows higher prices to persist.

Impact of High Mobile Data Costs on Digital Access

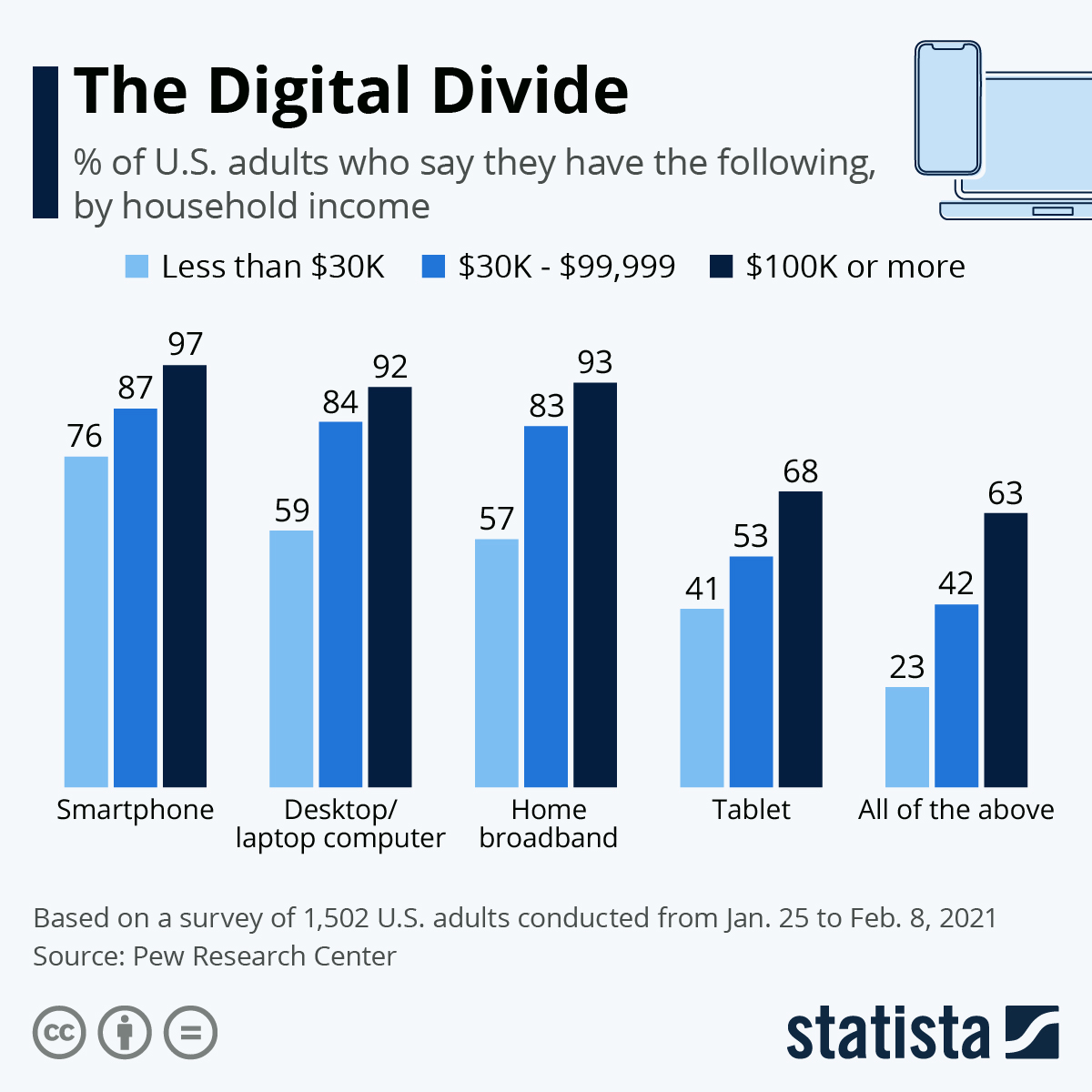

Digital Divide

High mobile data costs in regions like parts of Africa and the Pacific deepen the digital divide, limiting access to essential online services. In these areas, where fixed-line broadband is often unavailable or unreliable, mobile data is the primary gateway to the Internet. According to the International Telecommunication Union (ITU), only 37% of Africa’s population uses the Internet.

High costs can make even basic internet access unaffordable for many, cutting off opportunities for online education, telemedicine, and digital banking services. This lack of access means that many communities are excluded from crucial resources and information, further entrenching disparities between those who can afford connectivity and those who cannot. The digital access gap restricts individual opportunities and holds back broader economic progress as entire regions struggle to keep pace with more connected parts of the world.

Economic and Social Impact

In countries where mobile data is the main way to access the internet, high costs can significantly impact economic participation. Expensive data makes it difficult for individuals and small businesses to leverage online platforms for remote work, e-commerce, and digital marketing, which are increasingly critical in a global economy. This limits the ability of people to engage in the digital economy, reducing opportunities for employment and entrepreneurship. In the US, only 23% of adults with a household income of less than $30k say they own a smartphone, computer, home broadband and a tablet, compared to 63% of adults who earn a household income of $100k or more.

High data costs can also restrict access to valuable information, including news, government services, and digital learning resources, creating barriers to social development and informed citizenship. As a result, these regions’ economic and social potential remains underdeveloped, widening the gap between them and more connected parts of the world.

Source: Statista

Source: Statista

What Does the Future Hold for Mobile Data Pricing?

The future of telecom industry is closely tied to the evolving landscape of mobile data pricing, with several key trends likely to shape how prices develop in the coming years:

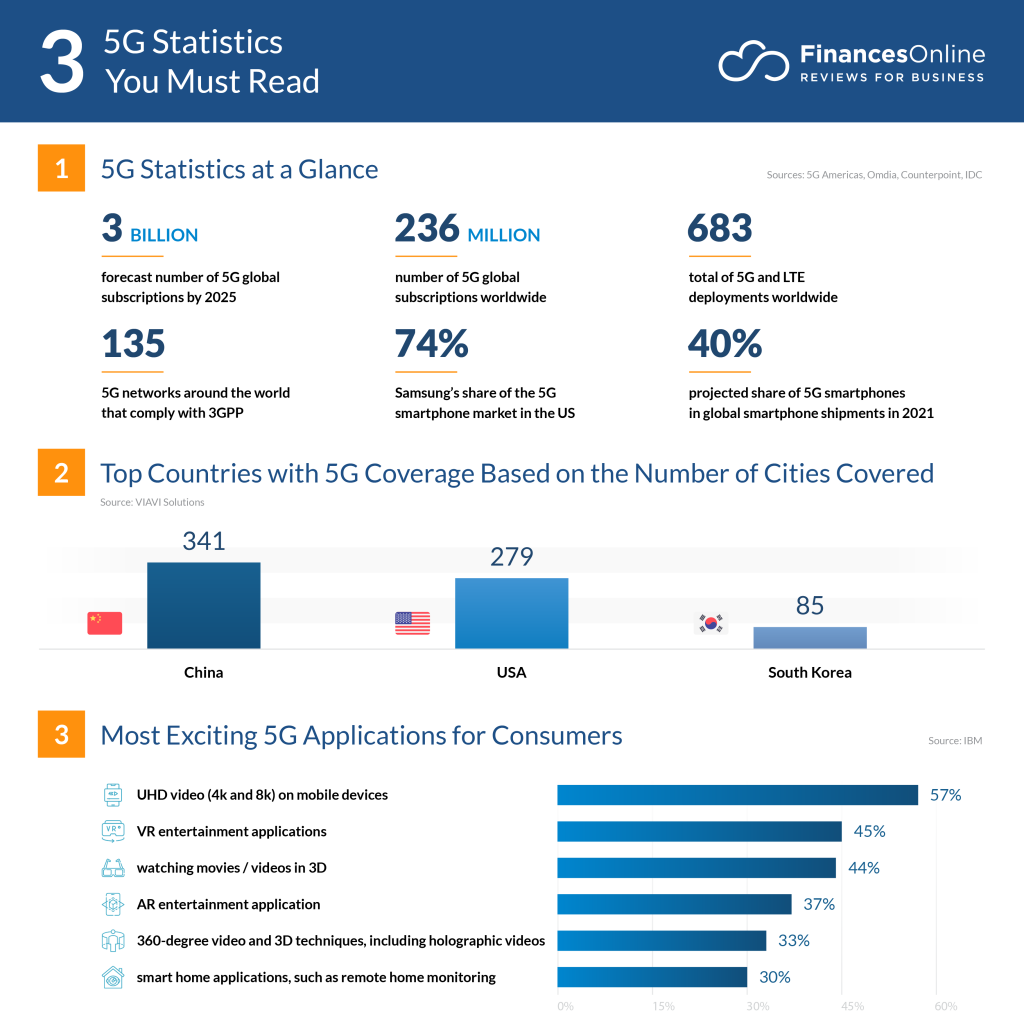

5G Adoption

As 5G networks continue to be deployed globally, this next-generation technology’s increased data capacity and efficiency can potentially reduce costs, especially in densely populated urban areas. With faster speeds and greater bandwidth, telecom providers can handle more traffic without a corresponding rise in costs, potentially passing those savings on to consumers. This could make data more affordable in markets where 5G adoption becomes widespread, thus reshaping the pricing structure of mobile data.

Source: FinancesOnline

Source: FinancesOnline

Improved Infrastructure in Developing Countries

The future will also see significant investments in expanding network infrastructure to underserved areas. Many developing regions are receiving international funding and support for network development alongside local government initiatives to bridge the digital divide. These efforts can lower the cost of delivering data, especially in rural and remote areas, as expanded coverage and new technologies reduce operational expenses for providers. Over time, these improvements will likely bring down mobile data prices in regions that previously faced high costs due to limited infrastructure.

Increased competition and policy changes

Regulatory reforms remain a critical factor in the future of telecom and its impact on data pricing. Governments and regulatory bodies in various regions are taking steps to encourage competition, such as reducing barriers to entry for new market players and promoting network sharing among providers. In markets currently dominated by a few providers, such as parts of Africa and some Pacific islands, such changes could introduce greater competition, leading to more competitive pricing. As regulations evolve, they can create a more dynamic and fairer marketplace, potentially driving down the cost of mobile data.

These trends collectively suggest a future where mobile data becomes more affordable and accessible as advancements in technology and policy continue to transform the telecom industry. However, the pace of change will vary by region, with some areas seeing faster improvements than others.

Conclusion

The global landscape of mobile data pricing is shaped by infrastructure, market competition, and regulatory environments. While countries with cheaper mobile data set benchmarks for affordability, regions with geographic challenges or limited competition face higher costs. As technology evolves and markets adapt, the hope is that mobile data will become more accessible and affordable worldwide, helping bridge the digital divide and supporting global digital transformation.

By understanding the factors that influence data costs, consumers, telecom providers, and policymakers can better navigate the evolving world of mobile connectivity, ensuring that the benefits of digital access reach everyone, everywhere.