The $26b rollercoaster ride, that is the T-Mobile-Sprint merger, continues. In this attempt to bring the two companies together, remembering that there have been multiple attempts in the past, the process has already run for about a year but it finally appears that the moons are aligning and a deal may be done within a matter of weeks. Key to receiving regulatory approval for the deal has been the divestiture of the Sprint-owned, Boost Mobile prepaid brand. This is in addition to network facilities and spectrum divestiture.

Regarding Boost, the key concern for regulators is ensuring that competition remains in the low income prepaid segment, of which Boost is a key participant, and therefore telecommunications services remain affordable for that end of the market. The rationale for this regulation is very justifiable. Sprint and T-Mobile coming together will likely create a more formidable competitor who can go head to head with Verizon and AT&T to compete for the lucrative higher ARPU customers. The risk the regulators are attempting to mitigate, is that post merger, the market will have 3 main carriers, all fighting for the higher end of the market and therefore leaving the lower end of the market neglected. Divesting Boost to a competitor who will see Boost, and its customer segment, as primary to its strategy, as opposed to secondary or even tertiary in focus, will ensure that its customers, and therefore that demographic as a whole, receive the focus needed.

There are also reports that regulators are requesting spectrum divestiture to enable the operation of a fourth carrier. This is less clear to me as an effective regulatory remedy. Replacing Sprint or T-Mobile with the same, or similar business model, seems that it could lead to a replication of the exact same issues that are behind the reasons for Sprint and T-Mobile merging in the first place. The merger has very much been marketed by both management teams as building a war chest to roll out a world-leading 5G network. For me, this is a convenient spin on the real drivers which are an increasingly competitive market, unsustainable pricing strategies and Sprint’s deteriorating bottom line. Stripping away the marketing hype around 5G and looking at Sprint’s financials, the merger appears to be more of a necessity to ensure Sprint, in whatever form, can continue as a business long term.

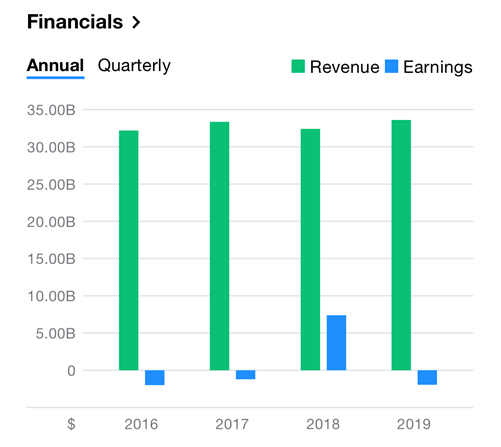

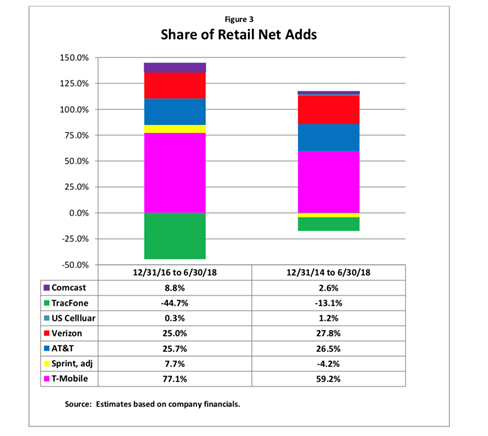

We can see that, with the exception of 2018, Sprint has been losing money consistently. Sprint has been losing share of gross additions, meaning they are losing the battle for new customers. Layer on broader market challenges and the situation looks challenging.

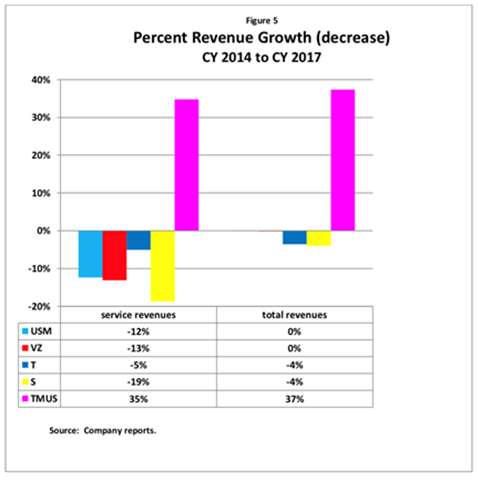

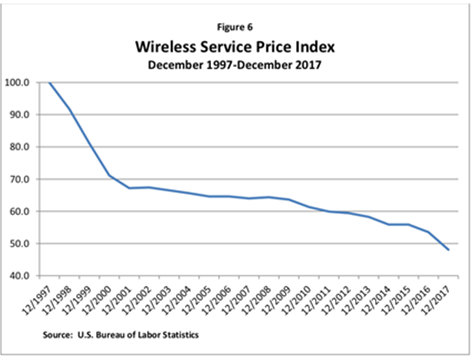

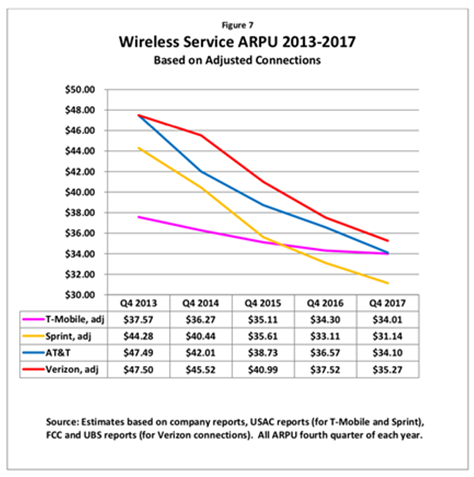

The US market has always been a high ARPU market but the inclusion of aggressive pricing strategies, unlimited plans, and in particular multi-line bundling offers, have meant it has become increasingly difficult to acquire customers and then retain them profitably. The series of graphs below show the issues that exist in the market.

With the exception of T-Mobile, most of the carriers have been going backwards in terms of revenues. This is then reinforced when analysing reported ARPU figures and general market pricing, both showing significant decline. This all paints a challenging picture for any operator but for Sprint, the combination of low to negative profitability and the fact they are losing the battle for new customers, means the merger appears to be essential.

Back to the spectrum question, the rationale very much depends on the details of this divestiture. It may be that a new MVNO wholesale deal could include options to acquire spectrum over time, and once the new business reaches significant scale. It could also be that regulators are wanting to ensure that there is not under-utilised spectrum owned by the combined business going forward and therefore divesting will offer a better opportunity for optimal utilisation.

Boost divestiture

There has been a heap of reports regarding potential suitors for the Boost acquisition ranging from Amazon, Charter, FreedomPop or to Peter Adderton, Boost’s original founder. But there is one suitor who appears to be rising to the top, Dish. Dish is a nationwide cable provider who competes with the likes of Comcast, Altice and Charter, to name but a few. Dish has yet to follow many of its peers by launching a mobile service. Strategically it makes sense for Dish to push into mobile. By bundling existing products with Mobile, it will create a stickier offering for its customers but equally as important, it will be better armed to defend itself against the competition. However, there is a more compelling reason. Dish, over the last few years, has been acquiring spectrum to the eye watering tune of $20b. It is now one of the largest holders of spectrum in the US market.

The case is a strong one for Dish, when looking at all the factors:

- Dish would acquire a profitable wireless business in Boost, likely at an attractive valuation.

- Boost also has significant subscriber numbers, at roughly 8.8 million subscribers (as per Sprint disclosure), Dish will have economies of scale that it can leverage with any new mobile service it launches. IMHO, it’s unlikely Dish would try to combine the Boost brand with its existing offering given that the target segments and marketing strategies might be too far apart for one brand to stretch to the other. Therefore, Boost might continue as a stand-alone brand, with Dish launching a new offering.

- At the same time, Dish is likely to receive a very advantageous MVNO hosting deal from T-Mobile, further increasing profitability of the existing Boost business.

- Dish has already invested in the spectrum. It would mean implementing the radio infrastructure, not a small undertaking, but my bet is that part of the divestiture will include infrastructure, not just spectrum. If that is the case, Dish would have an existing radio network that it could turn on with ‘relative’ ease. This, also, could suit T-Mobile and Sprint. They would likely be decommissioning some network infrastructure to realise cost synergies post the merger. Under this scenario, that infrastructure could be utilised by Dish, saving T-Mobile and Sprint the cost to decommission.

- This creates a nice path to a multi-play offering which Dish probably realises it needs to follow. Not only is it an easy path but they will be a strong player versus Comcast or Charter, which have had mixed success with their respective Mobile forays.

Combined, this creates a very compelling business case for Dish but also for Sprint, T-Mobile and the regulators. Not only would Dish be able to make use of its under-utilised spectrum, appeasing the regulators, it might also mean that regulators would require less spectrum divestitures from Sprint and T-Mobile, obviously to the delight of both companies.

Summary

Time will tell how the process plays out but needless to say there is much riding on the outcome. If the merger were not to receive regulatory approval, Sprint might find itself in a precarious position, obviously not to the benefit of the company but ultimately not to consumers either. A struggling carrier offers less in terms of innovation, investment and driving market competition. If Boost is divested, what will be the strategy of the new owner? And how will that strategy affect the dynamics of the low income, prepaid segment over the long term? There is a lot to play for. From my point of view, I think Dish makes the most sense, they have the resources, including a national sales network, to represent a meaningful competitor against the rest of the market.

I am, however, secretly rooting for a fellow Australian, Peter Adderton, the founder of Boost Mobile and current director of Boost Mobile Australia. He’s been vocal about his ambitions to buy Boost, and by all reports, he understands the dynamics of the prepaid segment as well as, if not better than, anyone. He is a true champion of the customer and I would guess that under his guidance Boost would be independent and therefore could be run with a customer first focus. Aussie Aussie Aussie, Oi Oi Oi!

By Hamish White

Hamish White is the Founder and CEO of Mobilise and is an international Mobile telecommunications expert with 20 years’ experience covering 4 continents, with a speciality in managing greenfield or transformation projects.