Extraordinary times, extraordinary measures.

This is a slightly off-piste blog post for us, but we cover a topic that is certainly worthwhile discussing given our current global situation with the Coronavirus.

We are living in exceptional times, there is no doubt. We are living an experience with the Coronavirus that, hopefully, none of us will have to experience twice. Although a very distant second to the health and well-being of our loved ones, the question of the economic impact of the Coronavirus is a topic that is becoming more and more prominent.

Whether it be the travel industry, hospitality or telecommunications there are few industries if any, that haven’t been significantly impacted by Coronavirus. I can talk first hand on our business and industry, telecommunications. Telecommunications here in the UK has been deemed an essential service, so for many workers, particularly those who support networks or physical infrastructure, are continuing their working activities as best as possible to keep critical communications services up and running for health, government, transport and other essential services. There are also huge increases in demand for teleworking applications and services with the likes of Zoom and MS Teams experiencing huge growth as a result of work from home orders by national governments around the world. Microsoft Teams increased its user base to 44m users up from 32m in just 1 week. However, the broader telecommunications industry is likely to struggle for many months to come, possibly longer. In our business, we rely quite heavily on conferences and events for our business development activities, but these have all but been cancelled for this year. We also normally travel extensively for client engagements, which can’t happen either. There is also a nervousness amongst our clients around committing to project spend in these uncertain times….hunker down, conserve cash for essential costs and ride out the storm. I believe the next three months will see some sign of normalcy return, the extended recovery could take much much longer, but at some point, there will be a rebound and I’d suggest it’ll be a strong one as critical projects that were postponed or paused, are pushed forward.

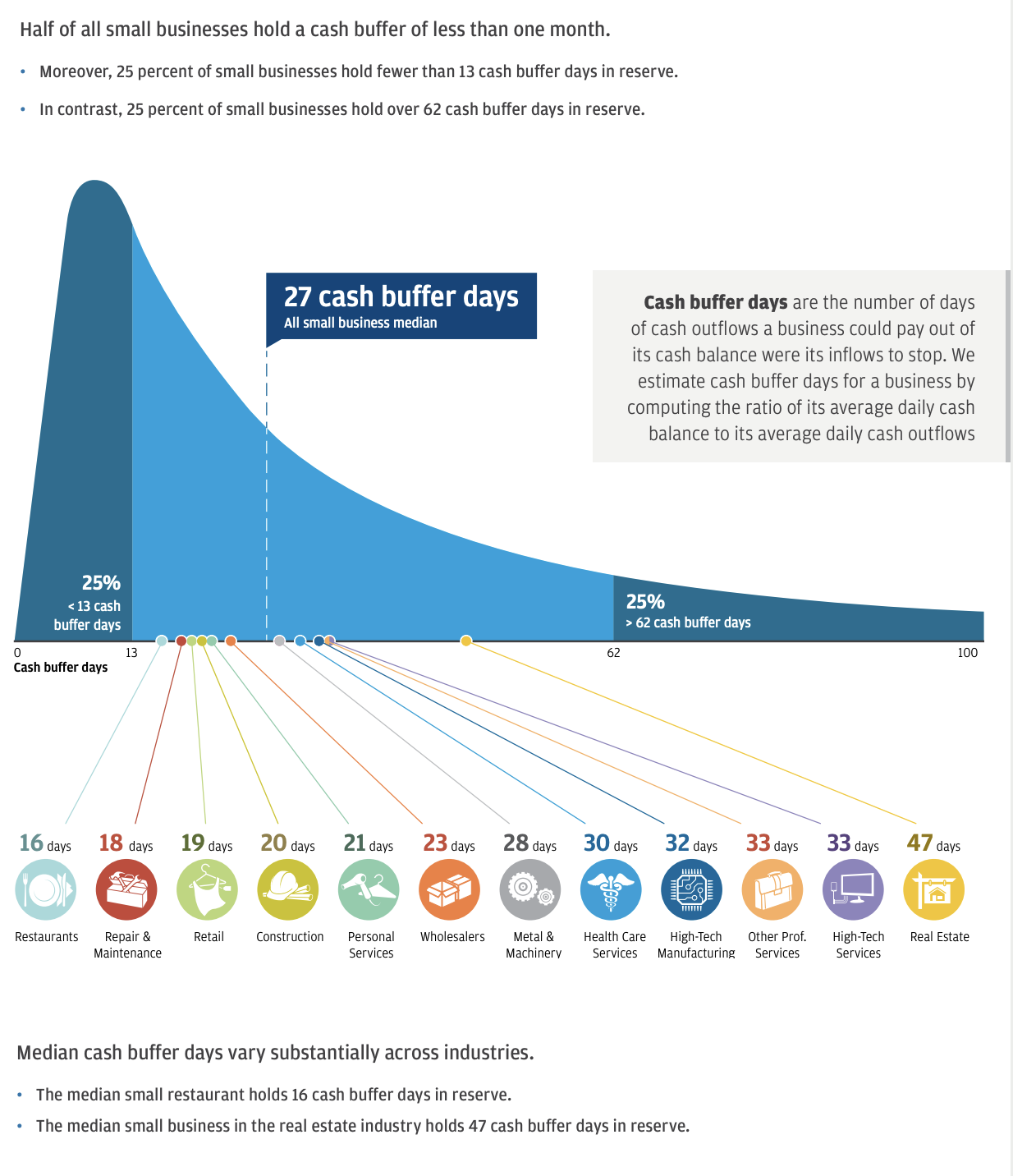

I read a post recently from Michael Jackson highlighting a survey that JPMorgan had run on SME’s and the amount of cash, on average, they hold in the business at any given time. The results are startling given our current circumstances and the forced closure of many businesses. However, at the same time, the results are not particularly surprising. One of the key takeaways is that, on average, SME’s hold 27 days cash buffer, meaning if all revenues were to dry up and costs continue, most SME’s would run out of cash in 27 days.

Source: JPMorgan Cash is King: Flows, Balances, and Buffer Days.

Source: JPMorgan Cash is King: Flows, Balances, and Buffer Days.

The statistics are based on US SME’s but I would suggest the UK has very similar metrics. When you couple the decline in revenues most SME’s will face from the Coronvirus related downturn with the fact that two of the largest fixed costs, people and rent, will be the hardest to reduce, it is easy to see that the challenge facing SME’s at this time is considerable. We are fortunate at Mobilise to have learnt some hard lesions over the years and now ensure we always have sufficient reserves, normally we aim for a minimum of 6 months, we are currently running at 12 months reserves.

When you layer on top of this issue the importance of SME’s to an economy, you start to see the gravity of the situation we are facing. In the U.K., for example, SMEs employ 16.6 million people (60% of the total workforce), whilst turnover is estimated at £2.2 trillion (52% of total) (source: fsb.ord.uk). SMEs are key to the health of our economies, which is why the government need to do all they can to support their survival during this time of uncertainty. The UK government has announced some great measures already including payment holidays on several forms of tax, bank loans guaranteed by the state and 80% of salaries covered for certain affected businesses. Some of these support measures will be costly long term but the short-term alternative of these companies going under is far worse.

There will be tough times ahead but we are sure the recovery will come, with considerable pent up demand to give us all a boost.

Stay safe and healthy…for us, in the meantime, we do our best to maintain sanity with kids and families working from home and whilst we all do our best to fight off cabin fever! 🙂