Introduction

In 2016, eSIM was introduced to the consumer market with the promise of revolutionising the telecom industry by replacing plastic SIM cards and enabling a completely digital customer experience. However, despite eSIM advantages—increased security, convenience, and sustainability—consumer awareness of eSIM in 2023 remained lower than anticipated. But things are predicted to change.

This blog will go into the current state and the future of eSIM awareness, explore the reasons behind its slow adoption and examine the implications for the telecom industry.

TL;DR

- eSIM awareness has slowed since its introduction in 2016, with only 36% awareness in 2023.

- Low consumer awareness is due to limited promotion from OEMs and service providers, leading to reduced adoption.

- The eSIM market is expected to expand, driven by growing device support and increased demand for travel eSIMs.

- Industry players need to invest in educating consumers about the benefits of eSIM and how it works.

- The future of eSIM looks promising, with significant potential for cost savings and improved customer experiences in the telecom industry.

eSIM Awareness – Past and Present

Past

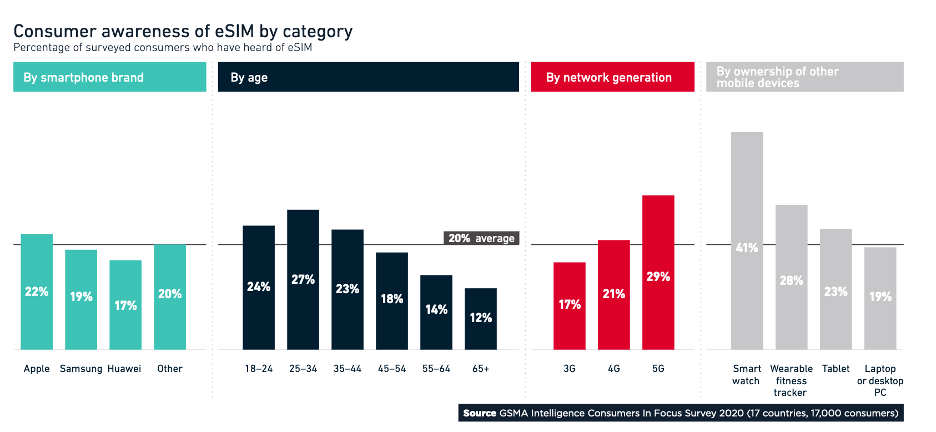

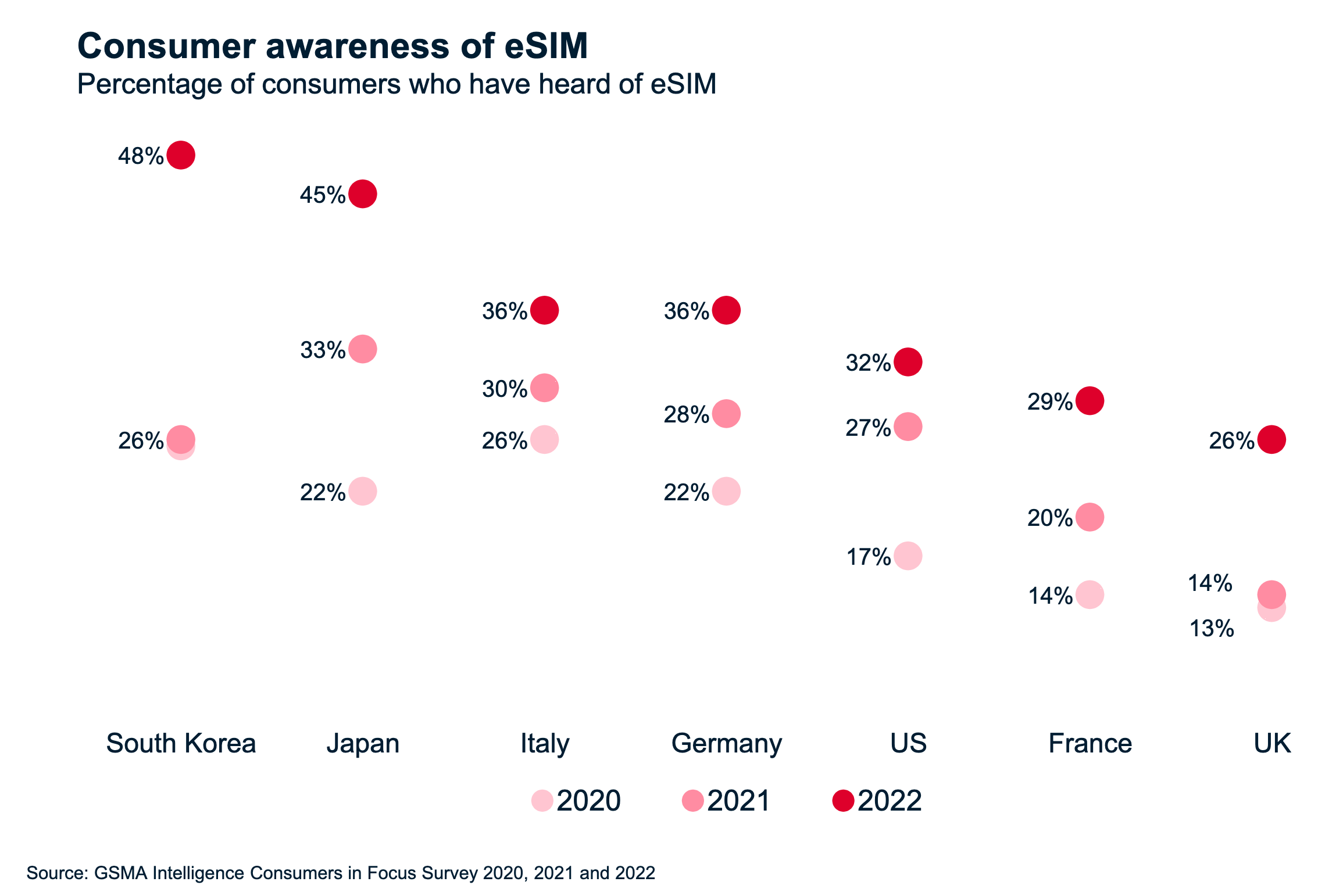

Though introduced in 2016, eSIM awareness was just 20% in a survey of 17 countries and grew to nearly 30% by 2022. Awareness levels varied by brand, age, and region but consistently lagged behind its potential (GSMA Intelligence).

Source: GSMA Intelligence

Source: GSMA Intelligence

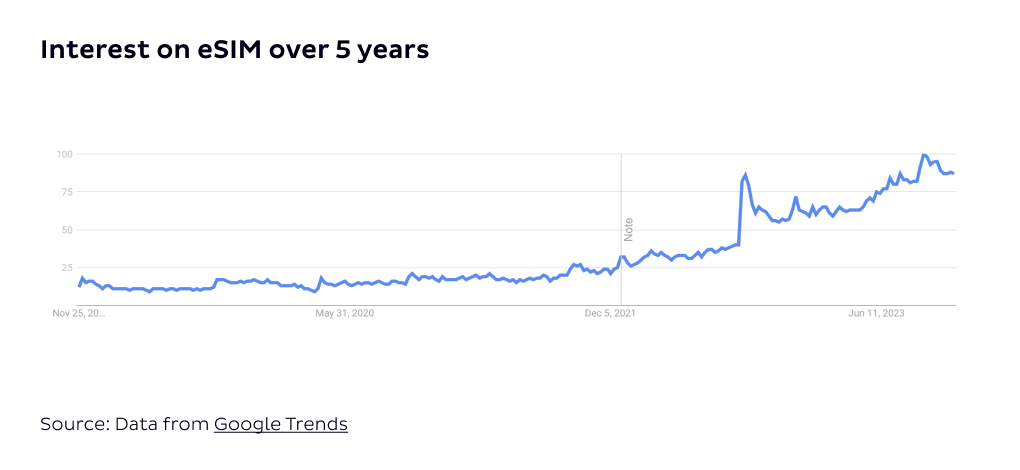

The launch of Apple’s eSIM-only iPhone in the US in September 2022 shocked the telecoms world. It caused almost double the interest in search results related to eSIM and increased consumers’ appetites for eSIM services, with consumer eSIM profile downloads surging by 130% in 2022 (TCA).

The industry was forced to adapt quickly to the changes. Since then, there’s been significant progress in consumer awareness of eSIM, but there are still areas that could be improved to facilitate wider adoption.

Source: Google Trends

Source: Google Trends

Present

In 2023, eSIM awareness climbed to 36%, ranging from 26% in the UK to 48% in South Korea, with younger consumers (aged 18-34) showing the highest awareness. Yet, despite these gains, awareness remains uneven, especially in Europe, where initial leadership in adoption has faltered.

Source: GSMA Intelligence

Source: GSMA Intelligence

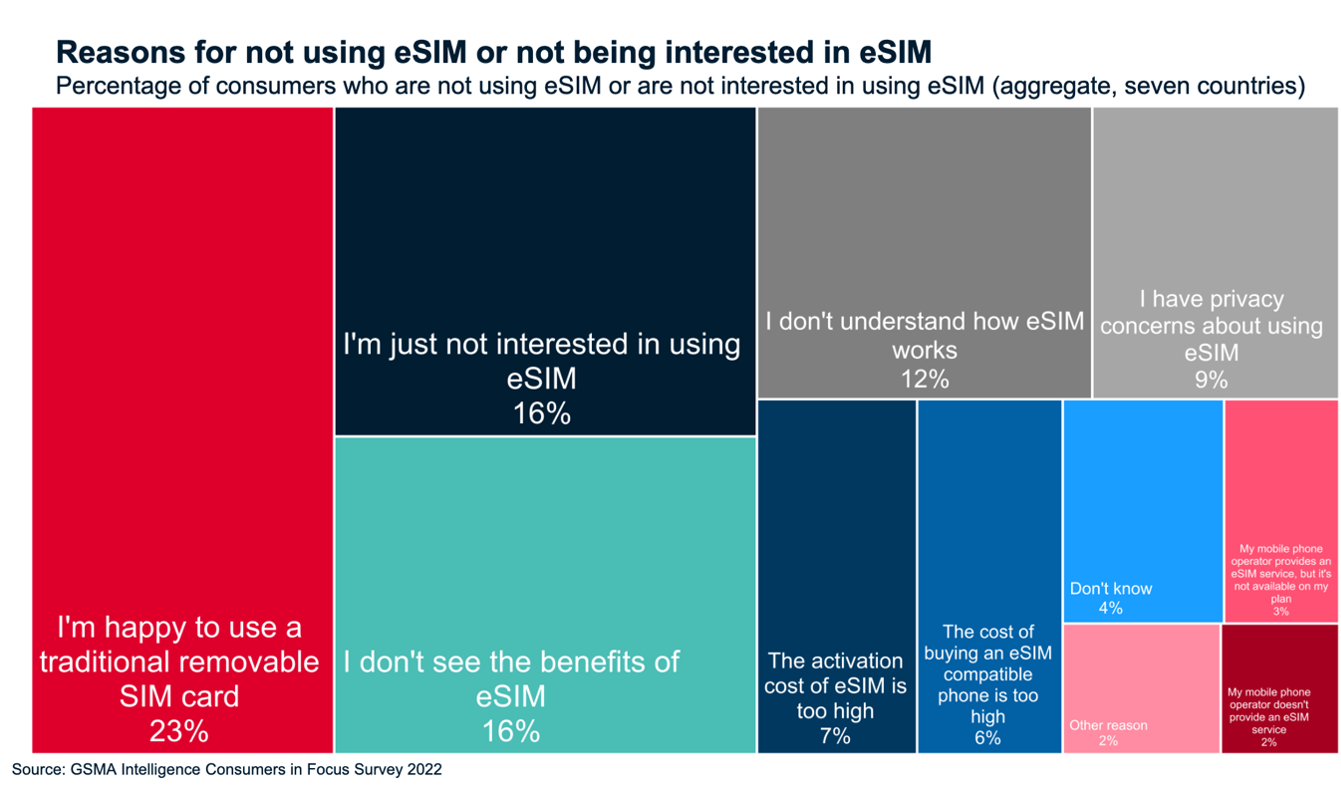

A different report by Statista showed that 58% of consumers in the US, UK, and Australia were aware of eSIM, reflecting higher adoption rates in these regions. However, many users still default to physical SIMs due to old habits and a lack of understanding of eSIM benefits. With 16% of consumers reporting that they don’t see the value of eSIM, it’s clear that OEMs and service providers need to promote the technology better.

Source: GSMA Intelligence

Source: GSMA Intelligence

The Reasons for Low Consumer Awareness of eSIM

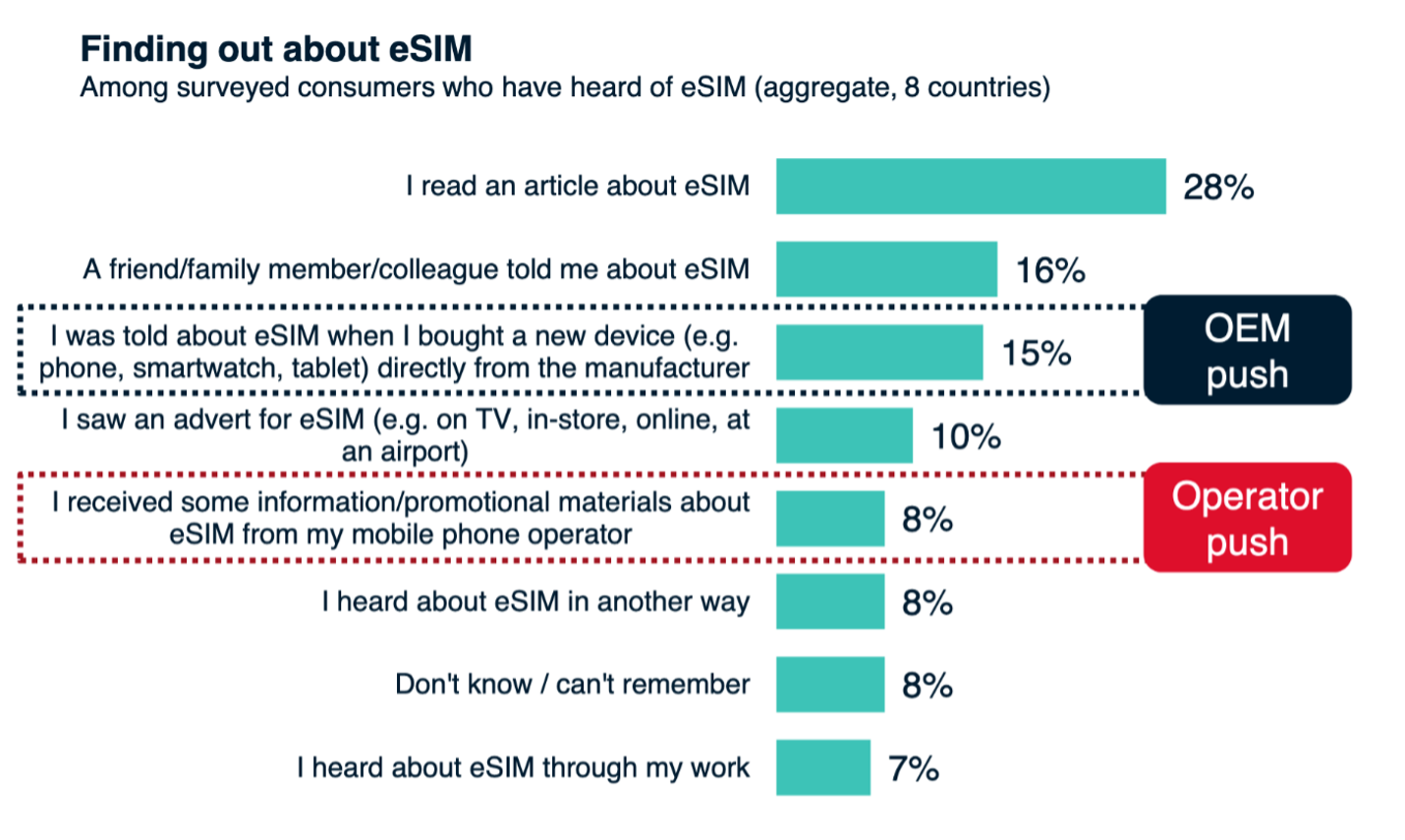

The GSMA found that more people learn about eSIM from articles (29%) or through word-of-mouth (15%) rather than from their smartphone manufacturer (14%) or mobile operator (10%), proving the reluctance of OEMs and mobile operators to promote and educate users on the benefits of eSIM.

Source: GSMA Intelligence

Source: GSMA Intelligence

While many OEMs now offer eSIM in addition to the physical SIM card tray, fewer than 1% of eSIM-equipped smartphones were actively using the technology in 2022 (LightReading). Many consumers were and remain today unaware of their devices’ eSIM capabilities; a Consumer Pulse 2022 report found that while only 32% of smartphone users believed their devices were eSIM-enabled, 74% actually supported the technology.

Source: GSMA Intelligence

Source: GSMA Intelligence

One notable attempt at promoting eSIM awareness among consumers was the launch of the eSIM-only iPhone 14 for the US market in 2022. However, another 2 generations of iPhones have been released since that have proved pretty disappointing for us at Mobilise. News of it continuing to be eSIM-only for the US market shot our hopes despite the rumours pointing otherwise.

Similar to OEMs, telecom operators have been quite stingy on promotional materials and consumer education. This is due to the fear of churn since eSIM enables quick and easy network switching. The majority of customers still receive physical SIM cards by default when signing up for new plans, making eSIM seem like a niche option.

For eSIM adoption to grow, telecom operators and OEMs must combine and concentrate their efforts to inform and educate the public on how eSIM works and the benefits it provides. Without it, consumers are unlikely to seek it out or prioritise the option when purchasing new devices or services.

RECOMMENDED READING

The Implications of Low Consumer Awareness of eSIM

The limited awareness about eSIM has significant implications for both consumers and the industry.

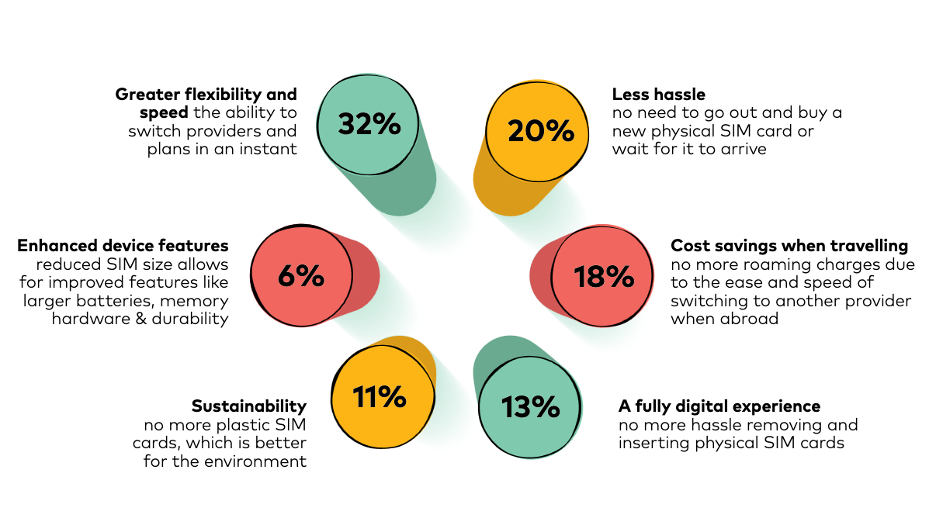

It translates to limited adoption, meaning that consumers miss out on the flexibility eSIM offers—such as easier network switching and using multiple profiles on one device.

Source: Amdocs

Source: Amdocs

For telecom operators, this delay in consumer uptake prevents them from fully realising the competitive advantages and operational efficiencies that eSIM can bring, such as reducing reliance on physical logistics for SIM cards. As we established in our Consumer eSIM White Paper, operators who fully switch to eSIMs look at up to 80% reduction in their SIM-related costs. To put it into perspective, a mobile operator with 1 million subscribers and approximately 50% gross additions per annum could save 1 million USD annually by switching to 100% eSIM provisioning.

Source: Mobilise’s Consumer eSIM White Paper

Source: Mobilise’s Consumer eSIM White Paper

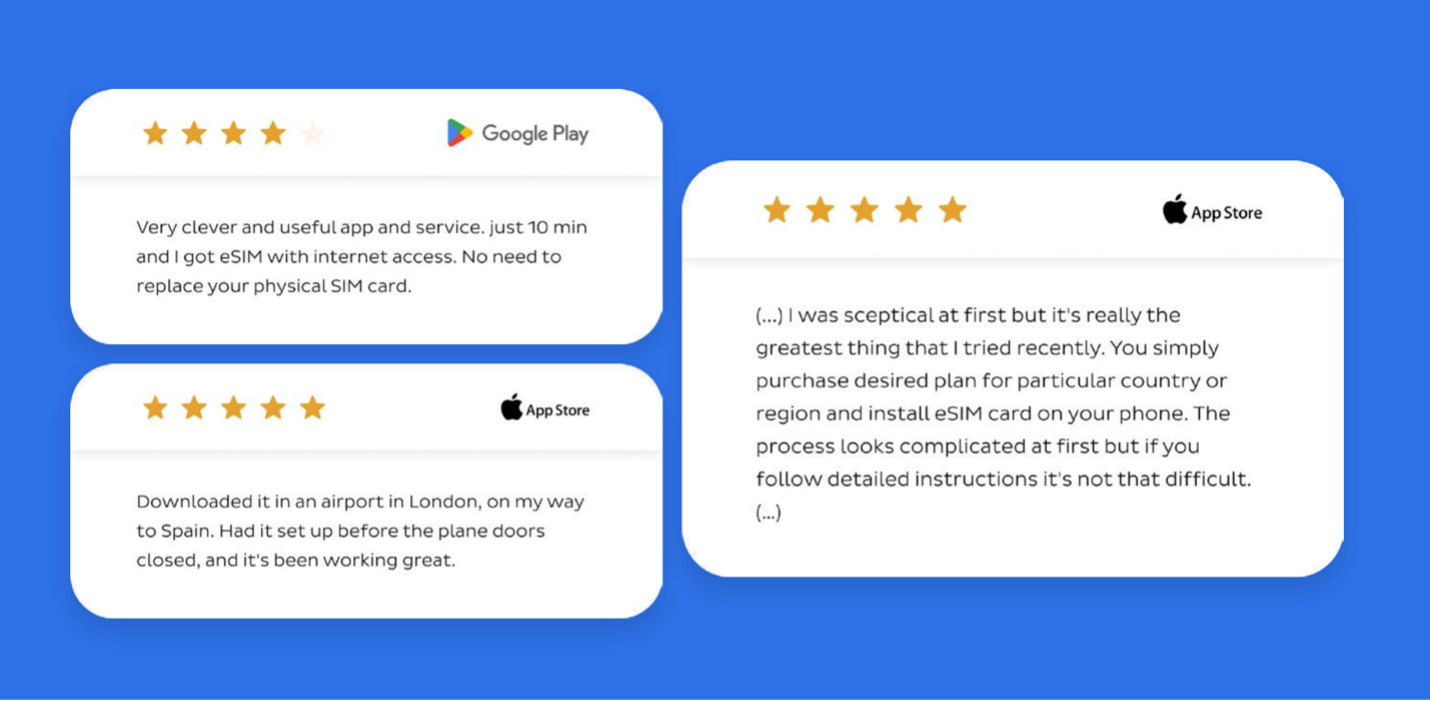

Additionally, low awareness stifles opportunities to innovate and streamline customer onboarding processes. This impacts the overall customer experience in telecom, which has historically been an underperforming aspect of the industry. In fact, 53% of customers stay with one telecom provider for less than 5 years due to bad customer experience.

Implementing fully digital customer onboarding driven by in-app eSIM activation could significantly elevate telecoms’ customer experience. It’s reflected in the customer reviews.

Source: eSIM Apps – Analysis of User Reviews

Source: eSIM Apps – Analysis of User Reviews

Furthermore, eSIM adoption could enable more seamless global roaming services and partnerships. However, operators fear that eSIM could facilitate customer churn, as switching providers becomes more effortless with eSIM than with physical SIM cards.

It’s time to flip that perspective and look at it from a new angle: yes, customers will switch to a better telecom provider, but what if we are that better provider because we offer seamless eSIM services?

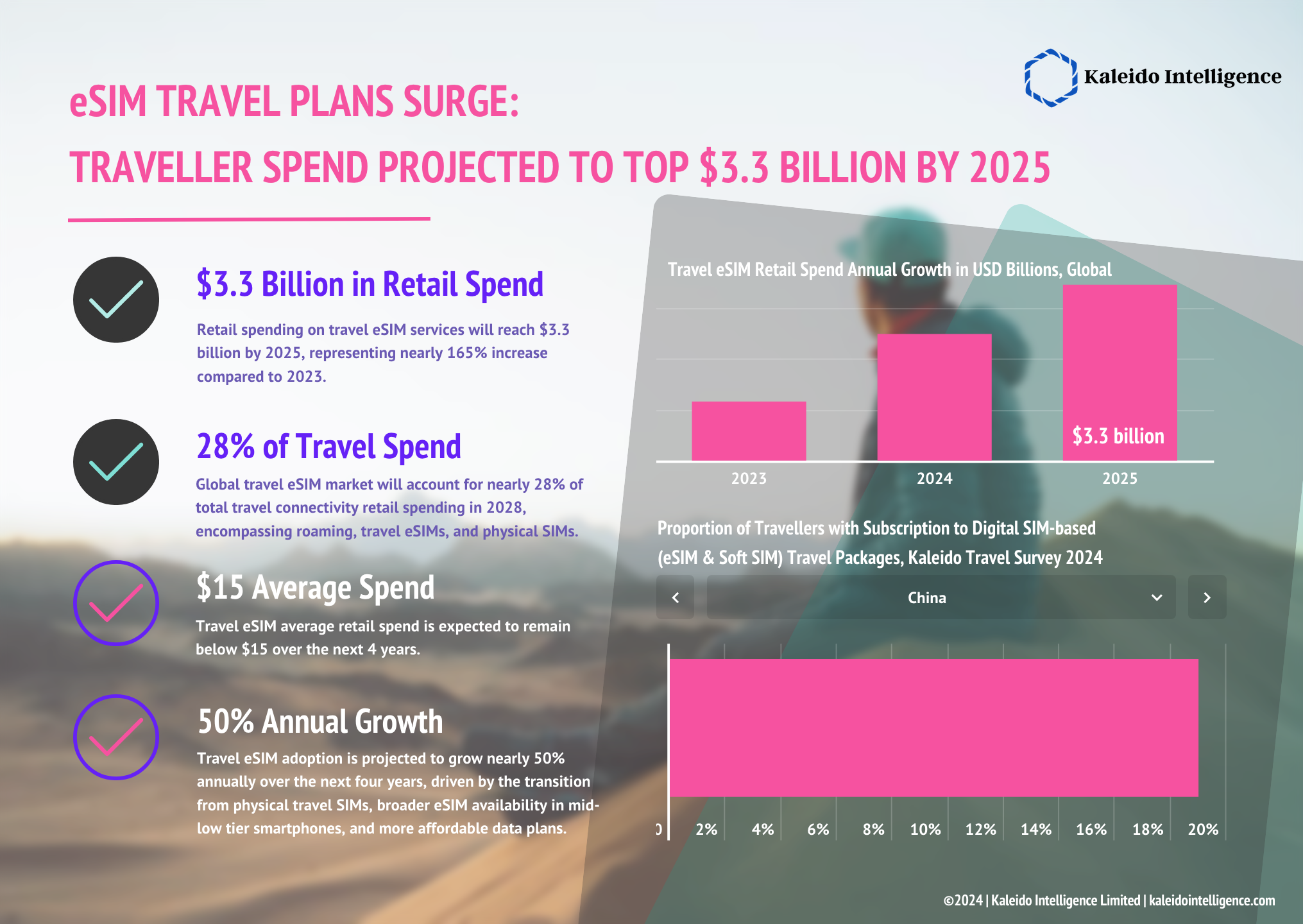

This new way of thinking may be beneficial. According to Kaleido Intelligence, the retail spending on travel eSIM services will reach $3.3 billion by 2025. That represents a nearly 165% increase compared to 2023. The adoption of travel eSIM is projected to grow 50% every year until 2028, creating a perfect opportunity for telecom providers to capitalise on the market.

Source: Kaleido Intelligence

Source: Kaleido Intelligence

As for OEMs, without understanding eSIM advantages, consumers are unlikely to seek out eSIM-supported devices actively.

Consumer eSIM was launched because manufacturers, mainly Apple, actively advocated for it as it frees up valuable real estate on consumer devices. Removing the physical SIM tray could result in improving other features, such as bigger batteries or advanced components, giving OEMs a competitive edge in a highly competitive market.

Conversely, many OEMs already offer eSIMs in addition to a physical SIM card slot. They must invest in both hardware and software to support eSIM technology, which increases the complexity of device production. When consumers aren’t aware of or don’t understand the benefits, this investment may not yield immediate returns.

In the long term, low adoption could slow down the overall digital transformation of telecom services. As other industries embrace digital technologies, the telecom sector risks falling behind if eSIM doesn’t become widely adopted, reducing the potential for creating more flexible, consumer-friendly ecosystems.

eSIM Awareness – The Future

Despite the current hurdles, the future of eSIM looks promising. The global eSIM market size is projected to reach USD 19.35 billion by 2031, growing at an estimated growing at an estimated compound annual growth rate (CAGR) of 10.5 % from 2023 to 2031. (Straits Research).

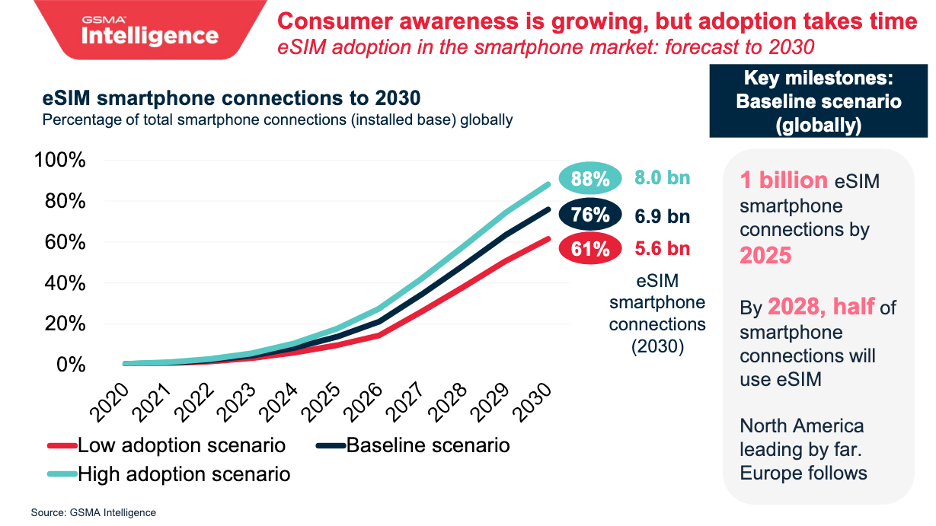

As eSIM-compatible devices become more mainstream, consumer awareness will likely increase. According to GSMA Intelligence, there will be 6.7 billion smartphone connections through eSIMs, accounting for approximately 76% of all smartphone connections by 2030. And 590 million devices, accounting for 67% of all smartphone shipments, will be eSIM-capable by 2027 (Statista).

Source: Mobilise, based on ABI Research

Source: Mobilise, based on ABI Research

Additionally, there’s a growing familiarity with and demand for travel eSIMs among travellers. This will drive the total expenditure in the travel eSIM market, which is estimated to grow from $1.7 billion in 2024 to between $8.7 billion and $10 billion by 2028, suggesting a much higher consumer awareness of eSIM.

The push towards a digital future—where physical components like SIM cards become obsolete—will only accelerate with time.

Conclusion

While consumer awareness of eSIM has been slower than anticipated since its introduction in 2016, the landscape is set to change as more OEMs and operators promote its benefits more frequently. Increased device capability, a growing market and demand for travel eSIMs will likely boost consumer understanding and adoption in the coming years.

However, for eSIM to reach its full potential, all players in the industry must actively educate consumers on the benefits and use cases of eSIM. Not only do consumers benefit from an uptake in eSIM adoption, but so does the telecom industry, which stands to benefit significantly – from reduced operational costs to a digital-first approach to customer experience.

Ultimately, embracing eSIM will be progressive in driving the industry’s digital transformation.

For more information on our eSIM as a Service offering, click here. Or click here to contact us and schedule a meeting.