The eSIM market is growing rapidly, driven by rising consumer demand, expanding device compatibility, and broader adoption across industries. From smartphones to smartwatches, laptops, and connected cars, eSIM is reshaping connectivity.

This is the third edition of our eSIM statistics blog, featuring the most important and up-to-date insights. We’ve also created a downloadable PDF to view all the statistics compiled in this blog. Click here to download!

Consumer eSIM Market Size & Worth

The eSIM market has been experiencing rapid growth in the consumer segment, fuelled by the increasing availability of eSIM-enabled smartphones, tablets, wearables, and other connected devices. While estimates vary depending on the specific market focus and methodology, the overall trajectory is clear: consumers are embracing eSIM technology at an accelerating pace.

The consumer-focused eSIM market was valued at approximately USD 1.22 billion in 2023 and is expected to reach USD 6.29 billion by 2030, growing at a remarkable compound annual growth rate (CAGR) of 20% from 2024 to 2032. These figures primarily reflect consumer-facing devices like smartphones and wearables rather than the entire market, which includes IoT and enterprise applications.

Source: Fortune Business Insights, Globe Newswire

Source: Fortune Business Insights, Globe Newswire

Considering IoT applications, the market was approximately USD 7.3 billion in 2021, USD 8.34 billion in 2022, USD 11.76 billion in 2023 and USD 13.54 billion in 2024. Forecasts suggest the market will hit USD 31.82 billion by 2030, growing at a CAGR of 15.27%. This marks a staggering 82% increase from previous estimates (USD 17.5 billion in 2024), underscoring the market’s rapidly expanding potential.

Consumer Segments Driving Market Growth

Several consumer segments are driving this growth. The connected cars and automotive segment held the largest share in 2023 at 24.2%, driven by advancements in 5G-integrated eSIM technology that enhance connectivity, mobility features, and emergency services. This was closely followed by consumer electronics, transport, and logistics (Fortune Business Insights). The consumer electronics segment, particularly wearables like smartwatches and smart glasses, is projected to grow at a CAGR of 27.9% during the 2023-2028 period (The Business Research Company).

Additionally, connectivity services dominate the consumer eSIM market, far outpacing hardware in terms of revenue generation. In 2023, connectivity services accounted for 88.6% of the total market, valued at approximately USD 4.2 billion. This segment is expected to grow at a CAGR of 25.7% from 2023 to 2028, highlighting strong consumer demand for flexible, software-driven connectivity solutions over traditional hardware (The Business Research Company).

Global eSIM Connections

In terms of actual connections, the GSMA reported 1.2 billion eSIM connections across smartphones, smartwatches, laptops, and tablets in 2021. These numbers were predicted to rise sharply, reaching 3.4 billion connections by 2025, with 25% to 40% of all smartphone connections worldwide expected to utilise eSIM technology.

In 2024 alone, smartphone connections using eSIM technology increased from 310 million in 2023 to 598 million, nearly doubling year on year. The GSMA forecasts 1 billion eSIM smartphone connections by 2025, which would represent substantial progress towards mainstream consumer adoption.

Source: GSMA Intelligence

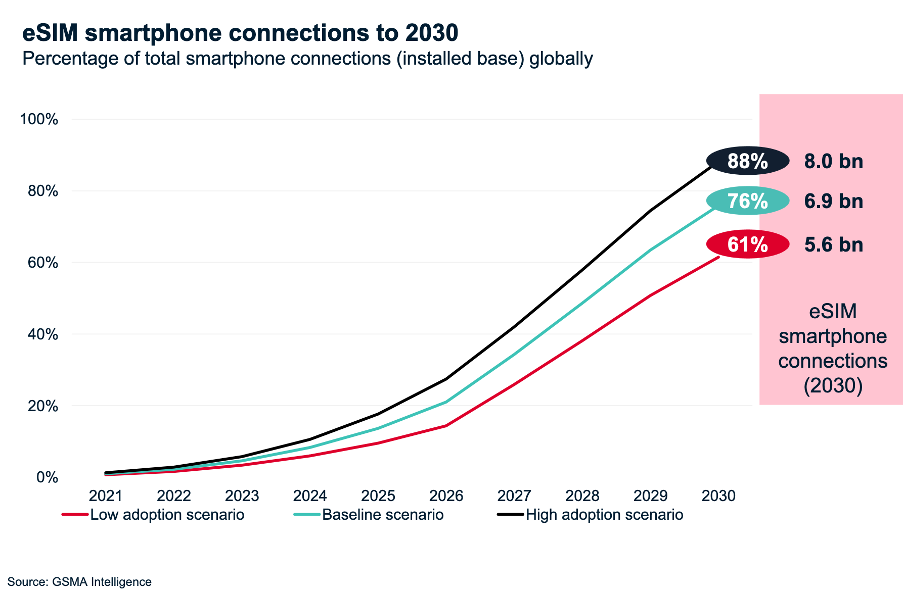

Looking further ahead, projections indicate that half of all smartphone connections could be eSIM-based by 2028. By 2030, estimates suggest that 76% of all smartphone connections – equivalent to 6.7 billion devices – will be made through eSIMs. Even under a low adoption scenario, that figure would still reach approximately 5.6 billion devices (61% of all connections). On the high end, an optimistic scenario would see 88% of all connections, or 8 billion devices, powered by eSIM technology.

The convenience, flexibility, and cost savings associated with eSIM technology drive the remarkable pace of consumer adoption. Consumers increasingly favour eSIM-enabled devices for their seamless connectivity, ability to support multiple profiles on a single device, and improved eSIM security features. With manufacturers like Apple and Samsung expanding their eSIM-compatible product lines and network operators scaling their support for the technology, consumer adoption shows no signs of slowing down.

Click here for a downloadable PDF to view all the statistics we’ve compiled in this blog!

Global eSIM Market Growth and Regional Dynamics

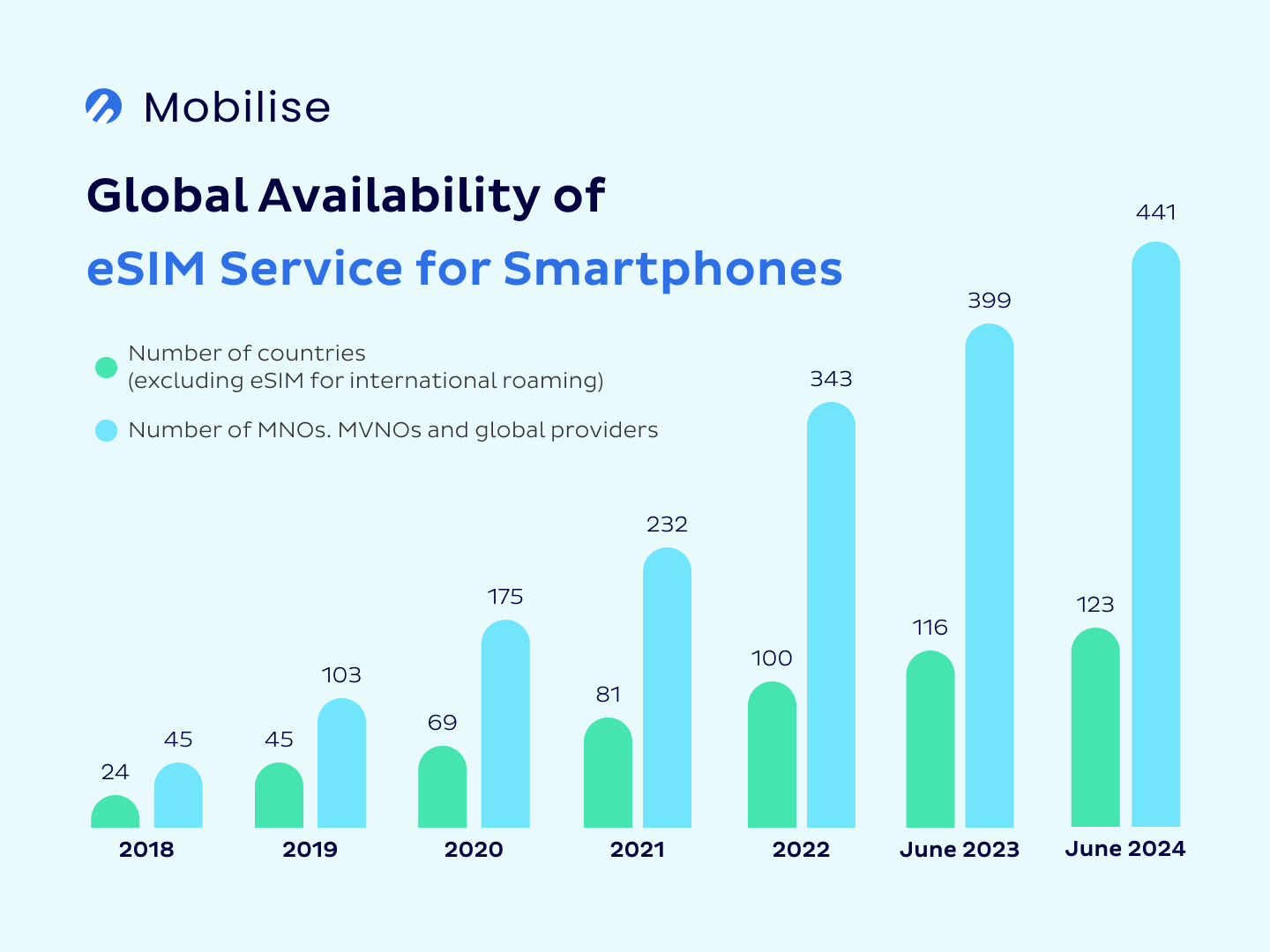

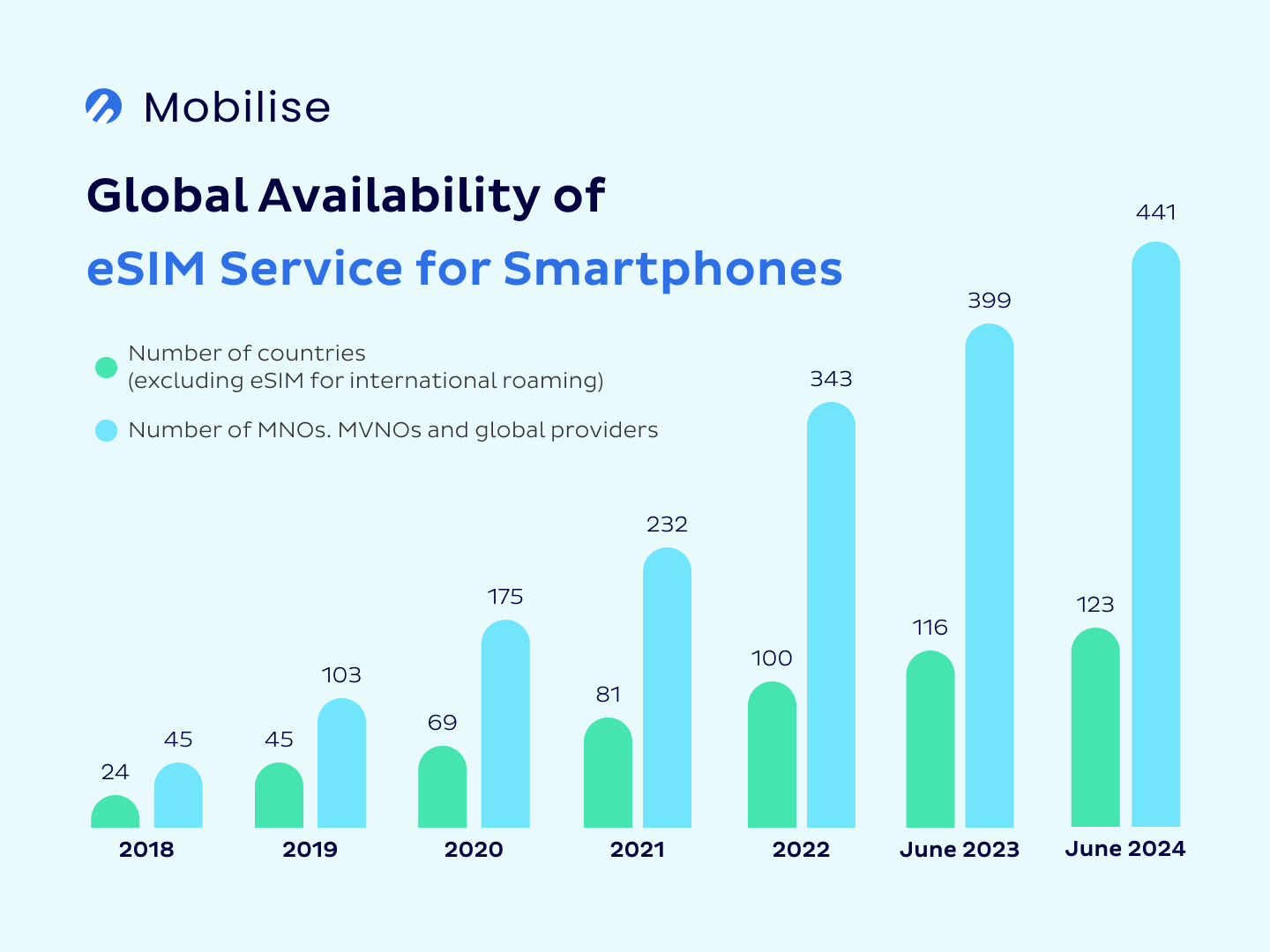

The global eSIM market is rapidly evolving, with regional dynamics shifting as adoption rates and technological advancements accelerate. Excluding eSIM for international roaming, eSIM is now present in 123 countries as of June 2024. This represents a consistent upward trajectory over the past few years and a 413% increase from 2018, when only 24 countries supported eSIM technology.

While the increase in eSIM-supporting countries has slowed over the recent years (from 54 new countries between 2019 and 2020 to 7 new countries between 2023 and 2024), the continued expansion of eSIM-compatible devices, alongside improvements in infrastructure and consumer awareness, is expected to drive further adoption in previously underpenetrated markets. The recent decrease reflects the gradual saturation of developed markets and a shift in focus toward scaling adoption across emerging economies.

Source: GSMA Intelligence

Source: GSMA Intelligence

North America

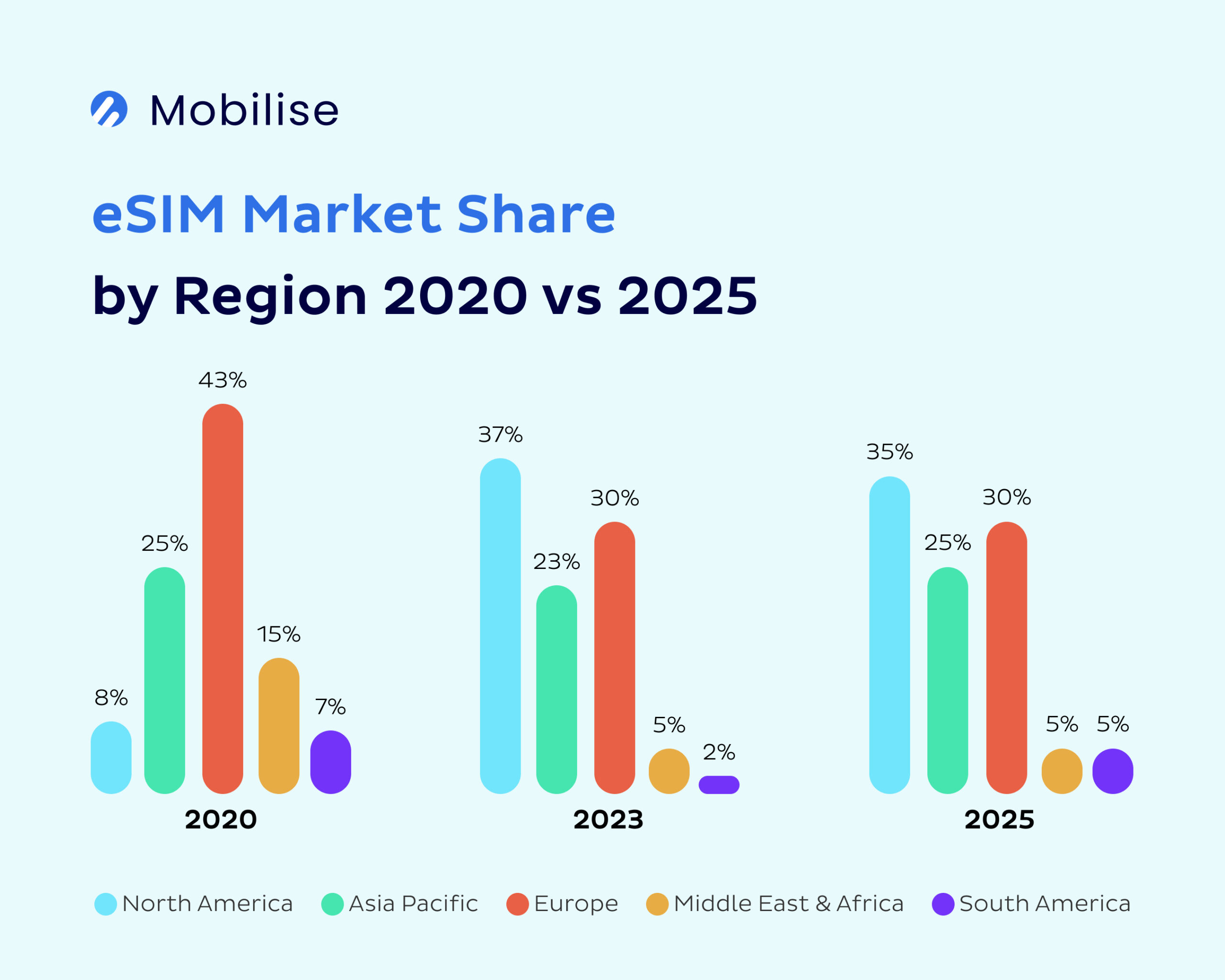

North America has emerged as the clear leader in recent years, driven by strong consumer demand for eSIM-enabled devices and strategic investments by major players like Apple, Alphabet, and Samsung. The launch of eSIM-only iPhones in the US in 2022 proved to be a turning point, solidifying North America’s dominance in the market.

By 2024, North America held 35-40% of the market share, with the United States alone accounting for 82% of that region’s revenue. Analysts estimate that North America’s market share will continue to expand at a CAGR of 8.7% between 2025 and 2032, making it the fastest-growing region.

Source: GSMA Intelligence

Source: GSMA Intelligence

Europe

Although North America currently holds the largest share of the global eSIM market, Europe’s influence remains strong. Historically, Europe led the market in 2020, followed by Asia Pacific, the Middle East and North Africa. By 2023, the European eSIM market generated a revenue of USD 2.57 billion and is projected to grow at a CAGR of 8.3% from 2024 to 2030.

Source: Mobilise, based on MRA, GSMA, The Business Research Company, Market.us, Cognitive Market Research

Source: Mobilise, based on MRA, GSMA, The Business Research Company, Market.us, Cognitive Market Research

The region’s growth is driven by increasing digitalisation, evolving regulatory requirements, and rising consumer demand for sustainability-focused solutions. France is at the forefront of this growth and is expected to be the fastest growing eSIM market globally over the next several years.

Other notable markets include the United Kingdom and Germany, which, alongside France, remain the primary revenue-generating nations. However, Italy is projected to register the highest CAGR in Europe from 2024 to 2030, highlighting the region’s ongoing dynamism and considerable growth potential.

Asia Pacific

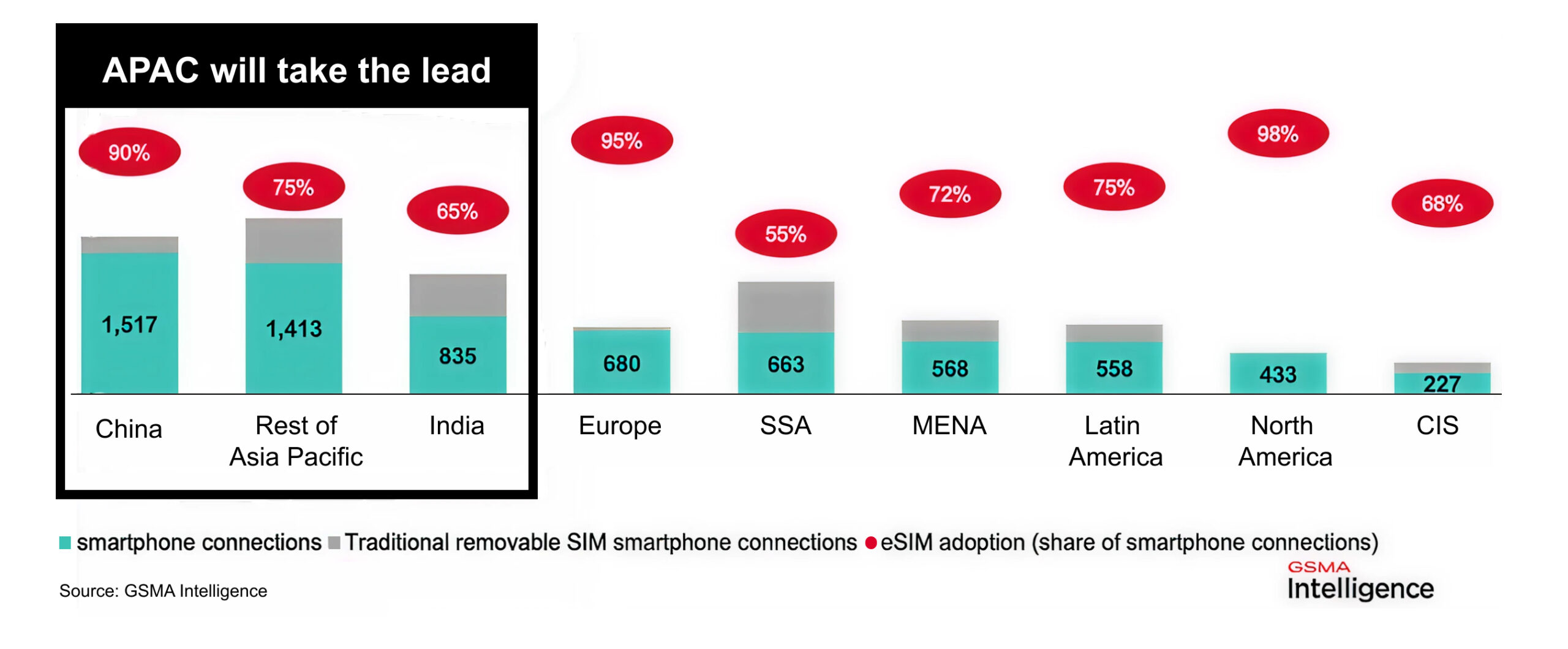

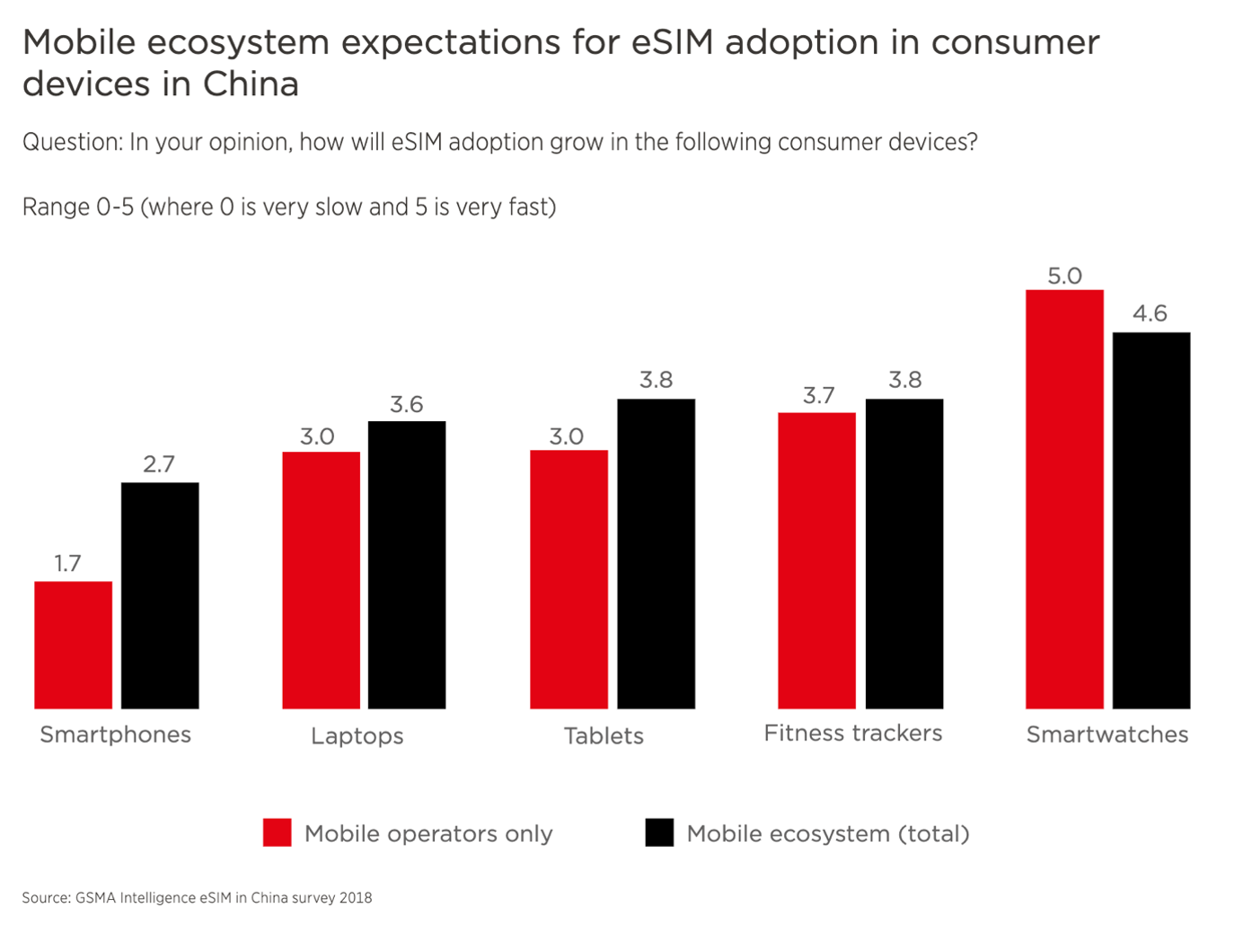

The Asia-Pacific region, however, is quickly closing the gap and emerging as the fastest-growing eSIM market overall. Analysts attribute this growth to rising consumer demand across India, South Korea, Japan, and particularly China.

Source: GSMA Intelligence

Source: GSMA Intelligence

As China continues accelerating its digital transformation, it is expected to become the largest eSIM market in the world by 2030, with 1.5 billion eSIM connections. The widespread adoption of connected devices across various industries, including smartwatches, automotive applications, and industrial IoT solutions, bolsters the region’s growth.

Source: GSMA Intelligence

Source: GSMA Intelligence

Latin America, the Middle East and Africa

Latin America, the Middle East and Africa are also making strides in eSIM adoption, taking 5% of the global market share each. Both regions are expected to show steady growth over the coming years.

The Middle East and Africa are experiencing a shift towards more flexible mobile connectivity solutions and growing e-commerce penetration, with Africa making the most significant strides – most of the 20 new eSIM-supporting countries in 2023 were countries from Africa.

Expanding telecom infrastructure and increasing digital adoption across various industries drive Latin America’s growth. Country-wise, Argentina is expected to register the highest CAGR from 2024 to 2030.

Current market share estimates reveal North America as the dominant region, followed by Europe and Asia-Pacific. However, the rapid growth of Asia-Pacific, coupled with China’s emergence as a major eSIM market, indicates that the global market landscape is far from settled. As technological advancements continue to roll out and new devices become eSIM-compatible, the regional balance of power will continue to evolve.

Click here for a downloadable PDF to view all the statistics we’ve compiled in this blog!

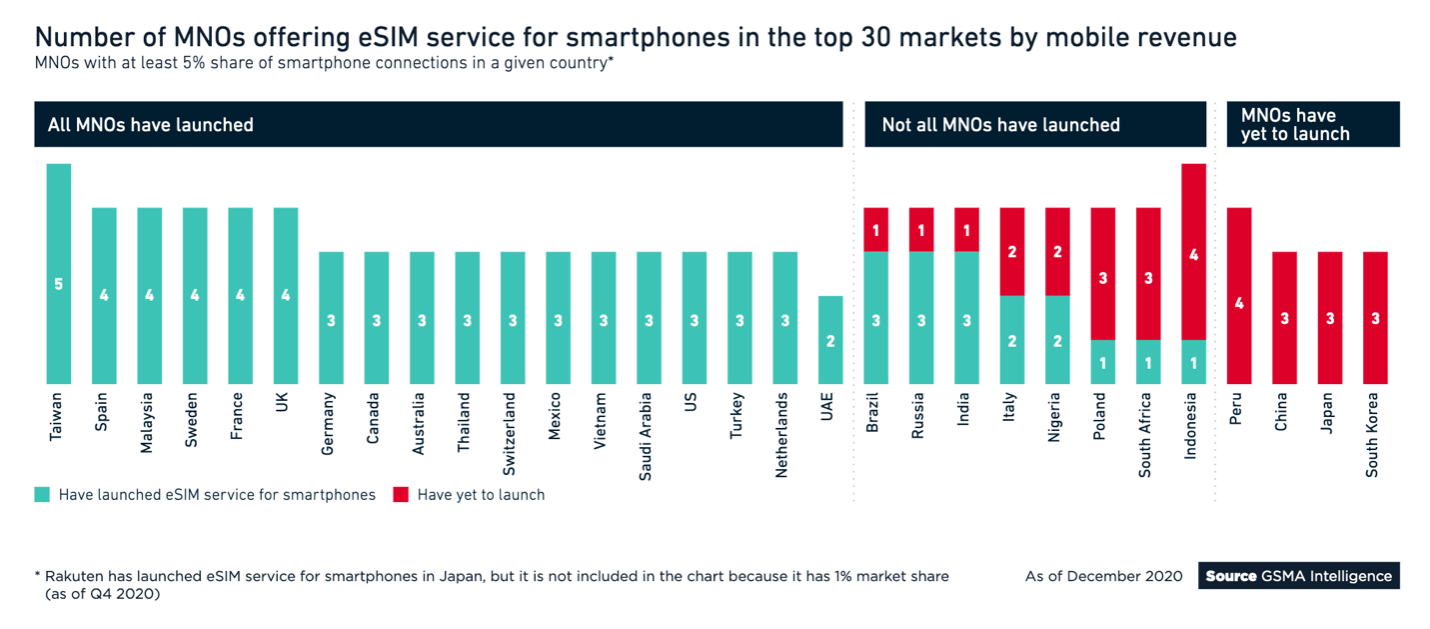

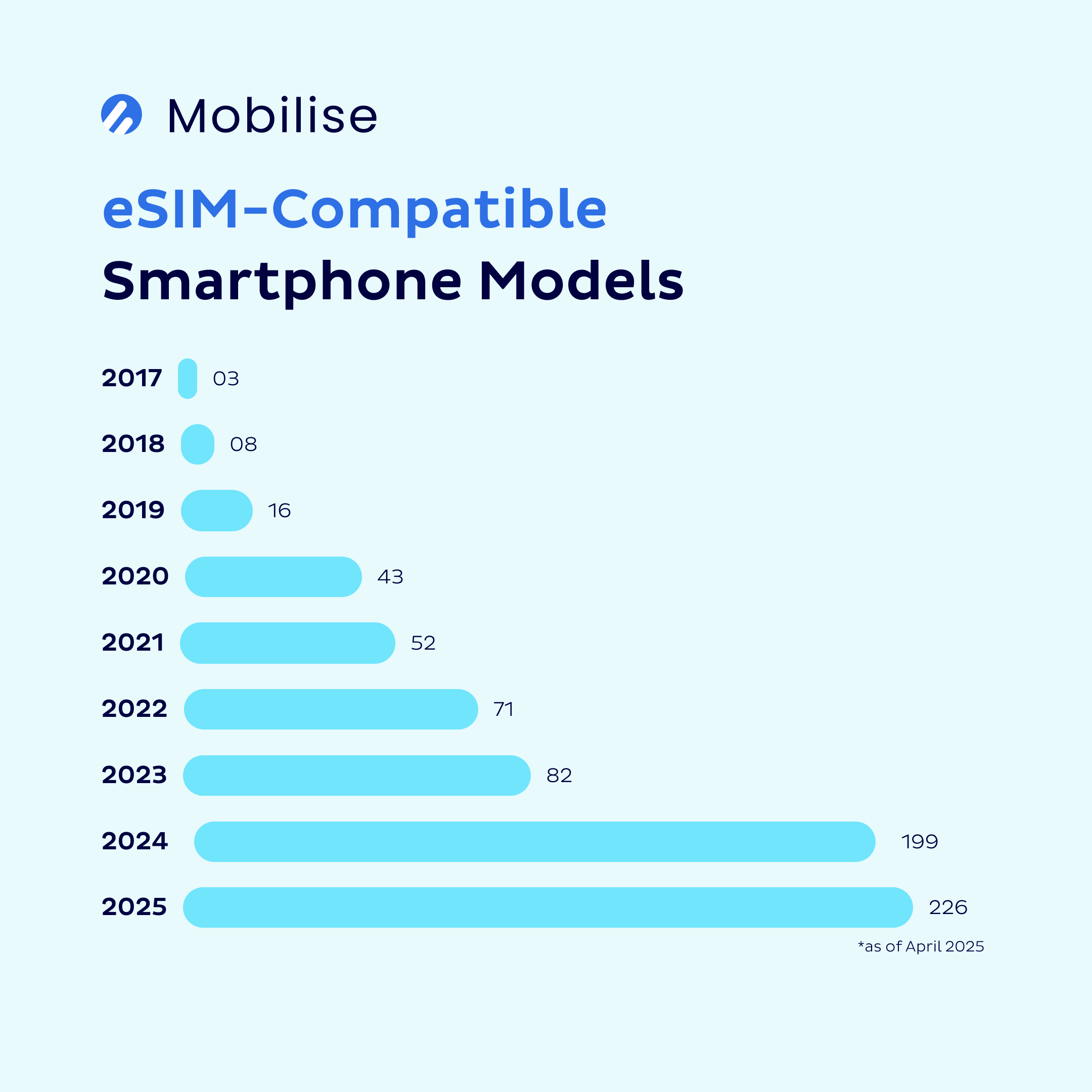

eSIM Adoption by Mobile Operators

If the GSMA’s predictions from 2021 were accurate, 90% of mobile operators would have launched eSIM offerings by 2025, with the most significant momentum expected to take place between 2021 and 2022. Unfortunately, that hasn’t been the case, at least not to the predicted extent. As of June 2024, 441 operators worldwide support eSIM, including MNOs, MVNOs, and international roaming services.

Source: GSMA Intelligence

Source: GSMA Intelligence

eSIM adoption peaked in 2022 when 111 new operators launched consumer eSIM offerings. However, this surge was primarily driven by the launch of digital eSIM brands and travel providers’ increasing uptake of eSIM. Following this high point, momentum has steadily declined. By June 2023, only 56 new operators had adopted eSIM, and the figure dropped further to 42 by June 2024. While these numbers suggest a slowing rate of adoption, likely, many of the remaining operators are currently working on eSIM implementation, with commercial launches expected soon.

Source: GSMA Intelligence

Source: GSMA Intelligence

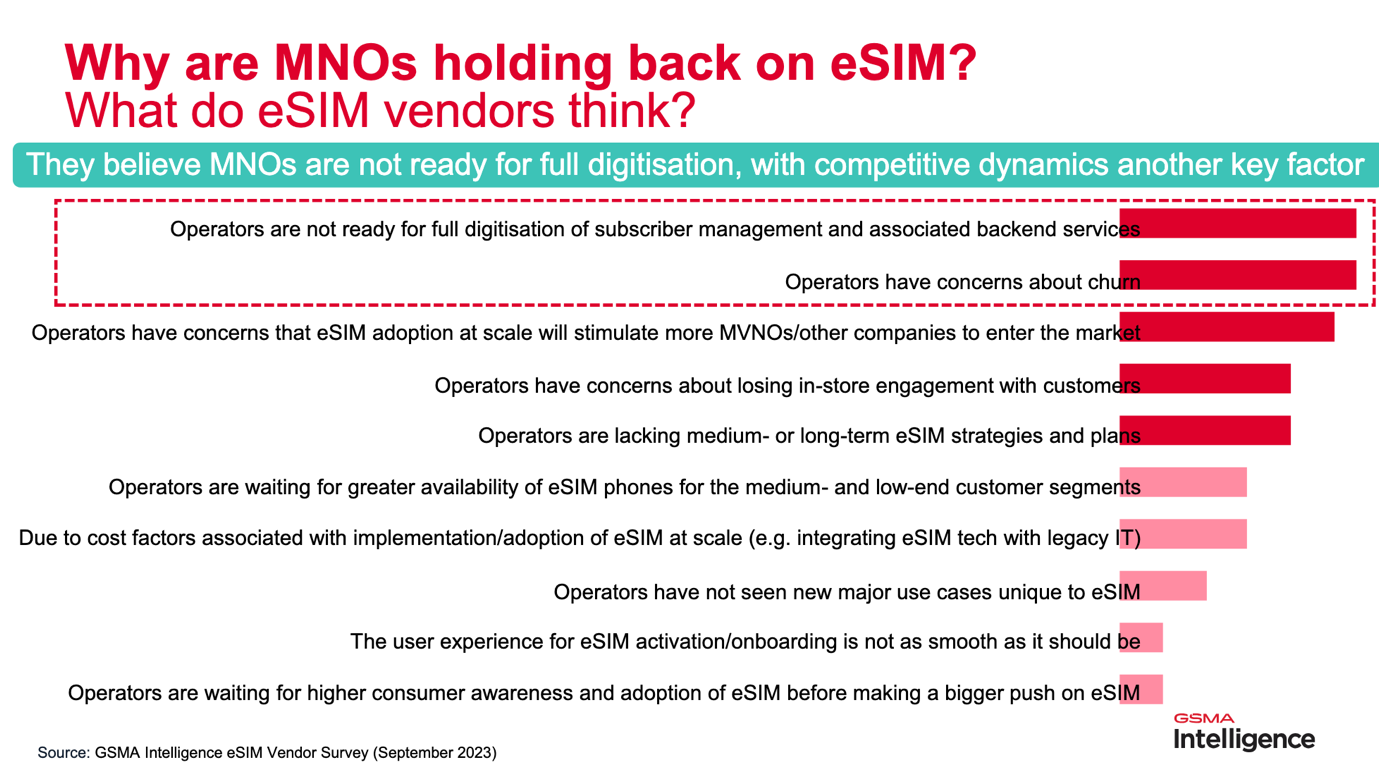

Despite the clear advantages of eSIM technology, many operators remain hesitant due to concerns about increased churn. Since switching providers is simpler with eSIM than with physical SIMs, some fear that eSIM adoption will encourage customer turnover. However, recent data from the US, where eSIM penetration is at its highest (around 30%), suggests otherwise. The launch of eSIM-only iPhones—an event that prompted many consumers to switch to eSIM—had no discernible impact on customer churn.

Source: GSMA Intelligence

Source: GSMA Intelligence

The eSIM momentum is likely to return in 2025. The first wave was initiated by the launch of eSIM-only iPhones in the US, and Apple is rumoured to extend eSIM-only functionality worldwide later in the year. What once seemed like speculative rumours are now gaining credibility, especially with reports that the next iPhone is designed to be the thinnest ever. Achieving this requires reclaiming all possible internal space, making eSIM technology a practical necessity.

When other OEMs follow suit, eSIM will rapidly become the standard. Operators that fail to launch eSIM services by then could face significant challenges, including losing valuable roaming revenue to travel eSIM providers. According to Juniper Research, traditional carriers could lose up to $11 billion in roaming revenue as consumers increasingly opt for digital-first providers offering alternative roaming solutions. The report recommends that operators develop and implement their own travel eSIM solutions to enhance existing roaming packages and prevent customer churn.

Click here for a downloadable PDF to view all the statistics we’ve compiled in this blog!

eSIM in the Travel Sector

The travel sector has become a pivotal force in the rapid adoption of eSIM technology. With consumers increasingly seeking convenient, affordable, and reliable connectivity options while abroad, the travel eSIM market is set to expand significantly over the coming years.

Rising Demand for Travel eSIMs

The demand for travel eSIMs is growing at an unprecedented pace. Retail spending on travel eSIM services provided by aggregators, MNOs, and MVNOs, is projected to increase by 500% between 2023 and 2028. By the end of this period, the global travel eSIM market is expected to approach a value of $10 billion, representing over 80% of the total travel SIM expenditure.

This growth is largely driven by travellers’ increasing preference for eSIMs over traditional roaming services. On average, travellers spend around $16 per trip on travel eSIMs, significantly lower than the $41 average roaming spend per trip. Given this cost difference, it’s no surprise that 9 in 10 travellers are ready to use travel eSIMs if provided the option.

Furthermore, retail spending on travel connectivity services, including roaming packages and travel SIMs, is forecasted to exceed $30 billion by 2028. Travel eSIMs are quickly establishing themselves as the go-to connectivity solution for international travel.

Regional Trends and Adoption Rates

The adoption of travel eSIMs is not evenly distributed across the globe. Regions like India, Brazil, UAE, Australia, Malaysia, and Singapore are seeing particularly strong growth. Meanwhile, Hong Kong, Malaysia, China, and Singapore are leading in physical travel SIM purchases, reflecting a growing interest in seamless connectivity.

In terms of user demographics, the younger generations are the most likely to adopt travel eSIMs. 71% of Millennials and 69% of Gen Z are likely to consider purchasing an eSIM, with 63% of Gen Z travellers expressing interest in buying data directly from travel operators like airlines or booking platforms.

However, while many travellers actively seek alternative connectivity solutions, 22% of travellers still opt to stay disconnected abroad, either favouring public Wi-Fi or choosing not to use mobile data at all. This is especially true for older generations, who may find traditional roaming too expensive or cumbersome.

Travel eSIM Adoption Drivers and Obstacles

Affordability and convenience are two of the most significant drivers of travel eSIM adoption. Notably, over 50% of travellers seek alternatives when roaming costs exceed $3-5 per day. Additionally, 70% of silent roamers – those who avoid using mobile data abroad due to high costs – are likely to adopt travel eSIMs if they become readily available.

Yet, despite these benefits, some barriers remain. About 27% of travellers are still unsure about using their travel operator to purchase mobile connectivity, highlighting an educational gap that presents a major opportunity for market players.

On a positive note, 75% of travellers now secure connectivity solutions like travel SIMs or eSIMs before their trips. This trend indicates that awareness of travel eSIM options is increasing, particularly among younger consumers who prioritise digital-first solutions.

Future Outlook for Travel eSIMs

The travel eSIM market is poised for exceptional growth. As awareness spreads and more providers introduce user-friendly packages, the industry is set to capture a significant portion of the travel connectivity market. The rapid rise in adoption is expected to continue, particularly among younger generations who value convenience and affordability.

However, traditional roaming solutions are not completely out of the picture. About 60% of travellers say they would use roaming if it were cheaper, suggesting that price remains a major factor in decision-making. Still, the eSIM market’s robust growth projections indicate that more consumers are willing to make the switch.

Looking ahead, companies that position themselves as leaders in travel eSIM offerings stand to benefit immensely. For now, the focus must be on education, marketing, and providing seamless user experiences to encourage wider adoption.

Click here for a downloadable PDF to view all the statistics we’ve compiled in this blog!

OEM & Device Support

The availability of eSIM-compatible consumer devices is a critical factor influencing eSIM adoption. Without sufficient device support, mobile operators may be reluctant to invest in eSIM infrastructure, and consumers will be unable to reap the benefits of this technology. Original Equipment Manufacturers (OEMs) are pivotal in facilitating eSIM uptake, but progress has been uneven across the industry.

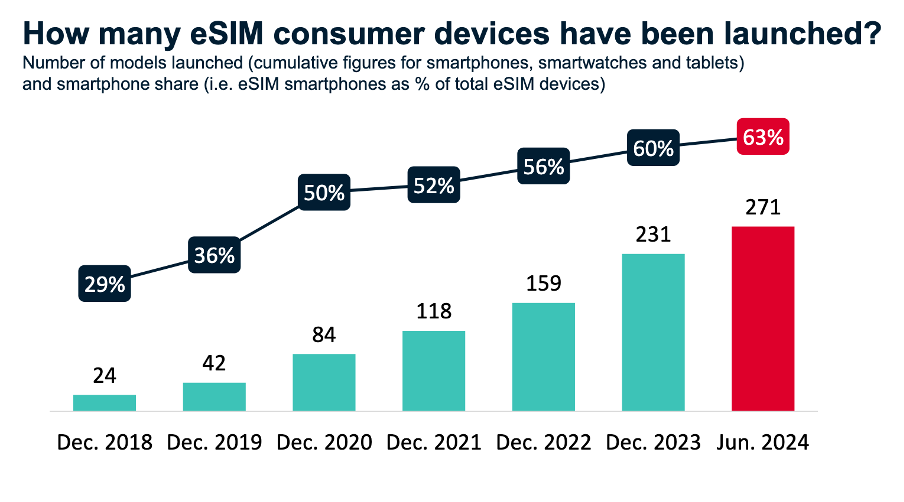

Adapted from: Counterpoint

Adapted from: Counterpoint

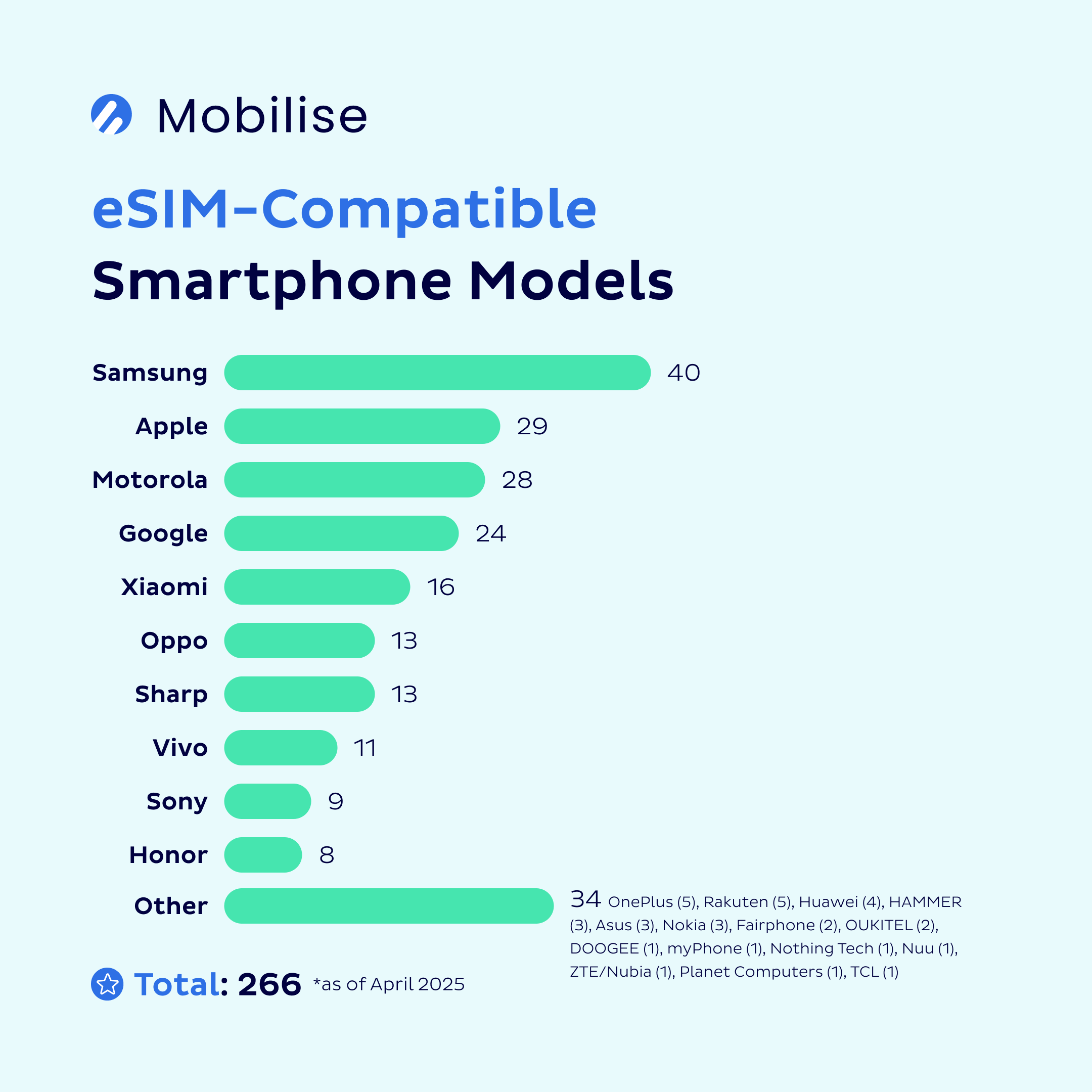

eSIM technology was initially launched in 2010 for the IoT market, but its use in consumer devices was only approved in 2016, primarily driven by Apple. Google released the first eSIM-capable consumer smartphone, the Pixel 2, in 2017, followed by Apple’s introduction of eSIM support in the iPhone XR and iPhone XS in 2018.

The first eSIM-only smartphone, the Motorola RAZR, was launched in 2019. However, the market was still immature and unprepared for a slot-less device at the time. The subsequent major development occurred in 2022, when Apple launched the eSIM-only iPhone 14 exclusively in the US, sparking ongoing momentum for eSIM adoption.

Apple continued this trend with the eSIM-only iPhone 15 and iPhone 16, released in 2023 and 2024, but continued limiting their eSIM-only functionality to the US. Despite expectations, Apple has not yet expanded eSIM-only devices to Europe. However, the upcoming iPhone 17, scheduled for release in September 2025, is expected to be the first eSIM-only model to be made globally available.

Current OEM Strategies and Device Availability

Source: Mobilise, based on Holafly

Source: Mobilise, based on Holafly

By 2025, OEMs will have adopted four different approaches to eSIM implementation:

- No eSIM models

- eSIM in select models (e.g. Samsung, Xiaomi, ZTE, Motorola, Vivo, Huawei, Oppo)

- eSIM in all models (e.g. Google, Apple)

- eSIM-only models (e.g. Apple in the US)

While progress is evident, these mixed approaches create confusion, limit accessibility, and slow overall adoption. A greater embrace of eSIM beyond flagship models is essential, particularly if adoption is to extend to emerging markets where affordable devices are crucial.

In 2017/2018, when only a few of the flagship models from the world’s leading smartphone manufacturers were equipped with eSIM technology, the price tags hovered around $1,000. In 2023, it was below $500. In 2025, one of the most affordable eSIM smartphones still retails for about $200. Even though eSIM-capable devices are becoming increasingly affordable, greater embracement is needed to boost adoption.

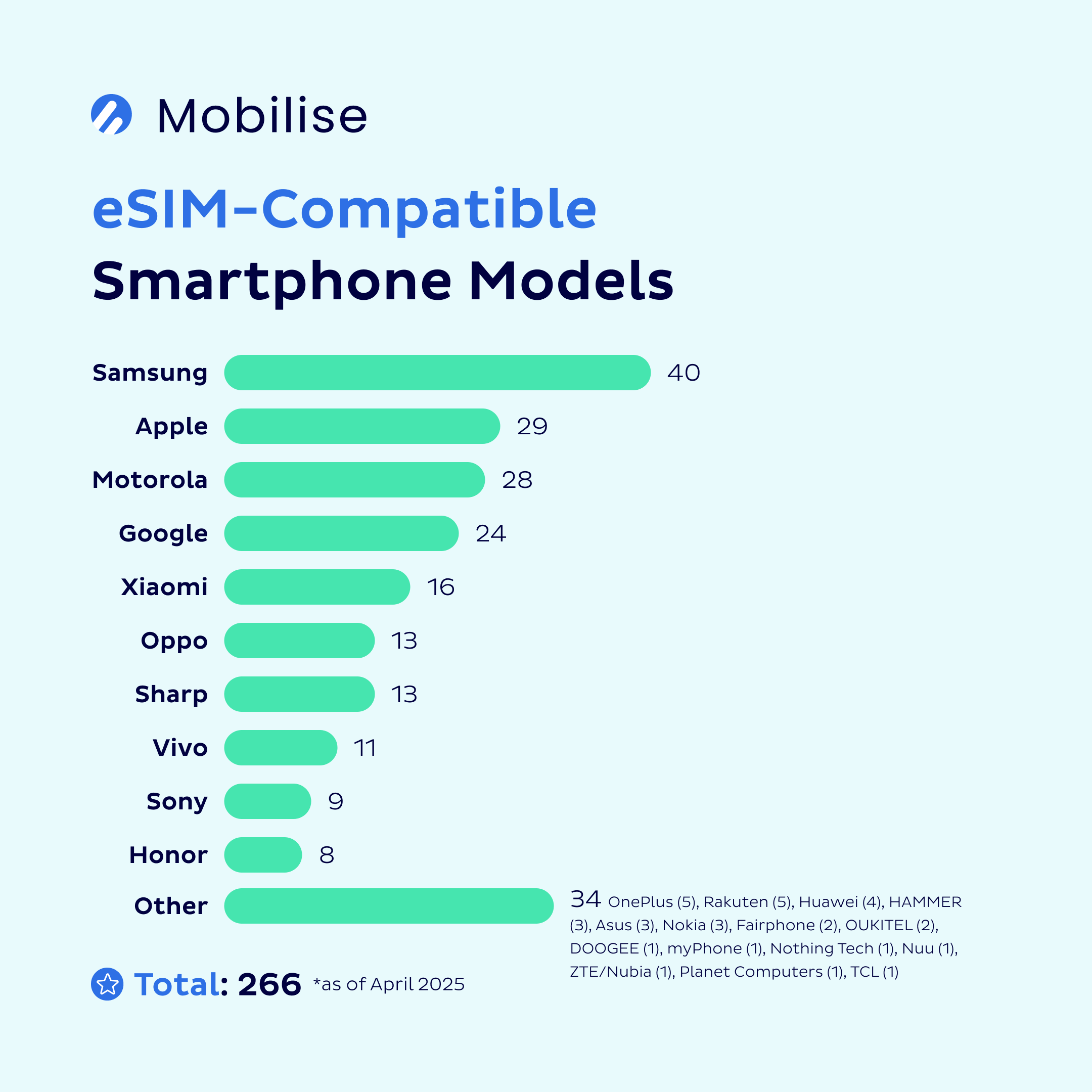

Brand Adoption and Market Penetration

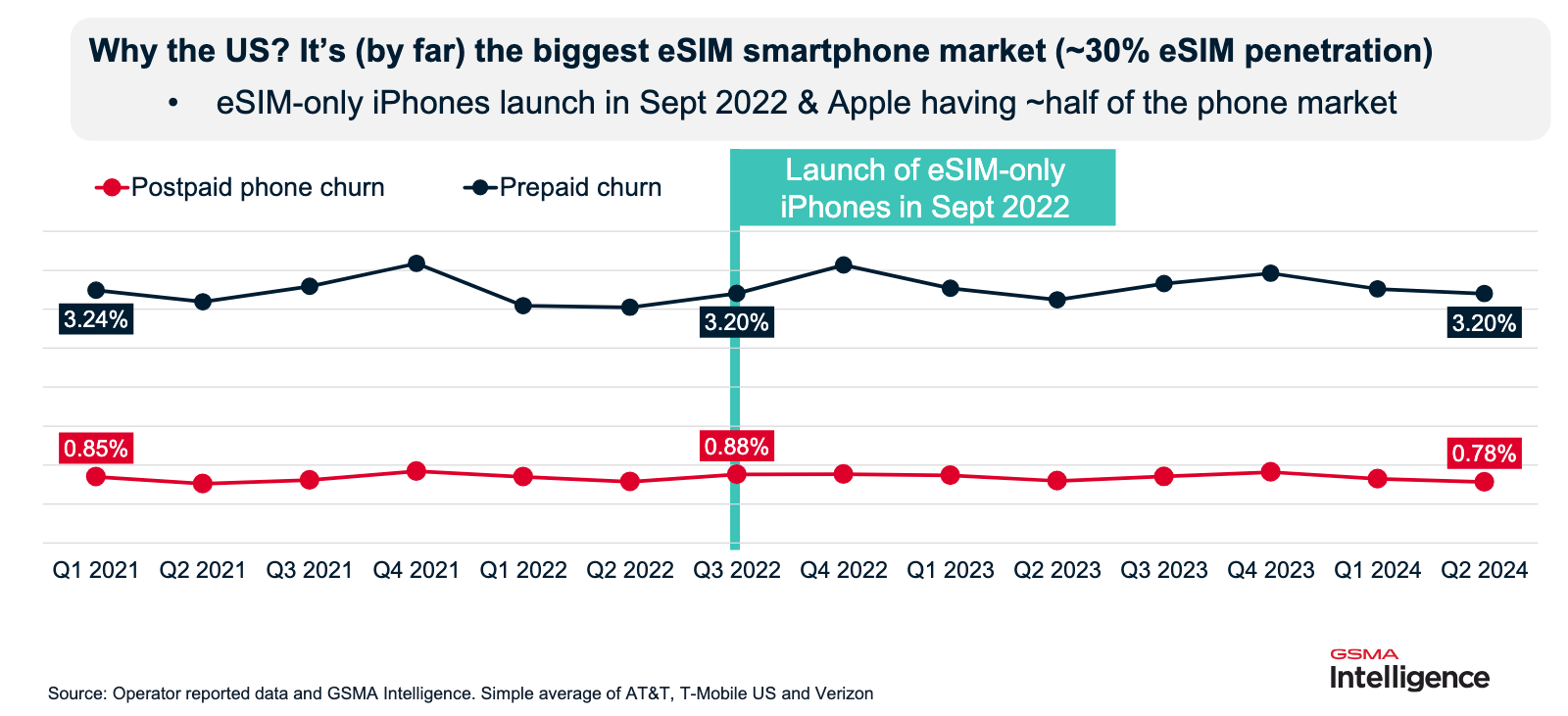

According to a 2021 survey, over 80% of manufacturers planned to adopt eSIMs by 2025. There were almost 250 active smartphone brands worldwide in 2023; if 80% had adopted eSIM technology, that would amount to around 200 brands. However, by April 2025, only 25 brands, a mere 10% of all handset suppliers, had adopted eSIM technology.

Despite this relatively low percentage, the 25 brands that have adopted eSIM are significant players with high market share across all regions. This suggests that, while broader adoption remains limited, the most influential manufacturers are setting the trend for the rest of the industry to follow.

Source: GSMA Intelligence

Source: GSMA Intelligence

The number of eSIM-compatible smartphone models has also increased significantly. In April 2024, there were 169 eSIM-compatible smartphone models. By April 2025, this number rose to 226, reflecting a 33% year-on-year increase. It doesn’t compare to the 106% YoY increase in 2023/2024, but still higher than the average 24% YoY increases between 2021 and 2023.

Source: Mobilise, based on Holafly

Source: Mobilise, based on Holafly

The current leading trio of eSIM-capable smartphone manufacturers includes Samsung, Apple, and Motorola, with 40, 29, and 28 eSIM-compatible smartphones, respectively. While Samsung and Apple have maintained their positions, Motorola has overtaken Google to secure third place.

In terms of the highest increase in eSIM-compatible models released:

- Samsung leads with 10 new models since April 2024.

- Motorola and Vivo follow closely with 8 new models each.

- Xiaomi and Apple have released 5 new models each.

Additionally, several new OEMs joined the eSIM-compatibility bandwagon in the last year:

- Asus with 3 devices.

- Nothing Tech with 1 device.

- TCL with 1 device.

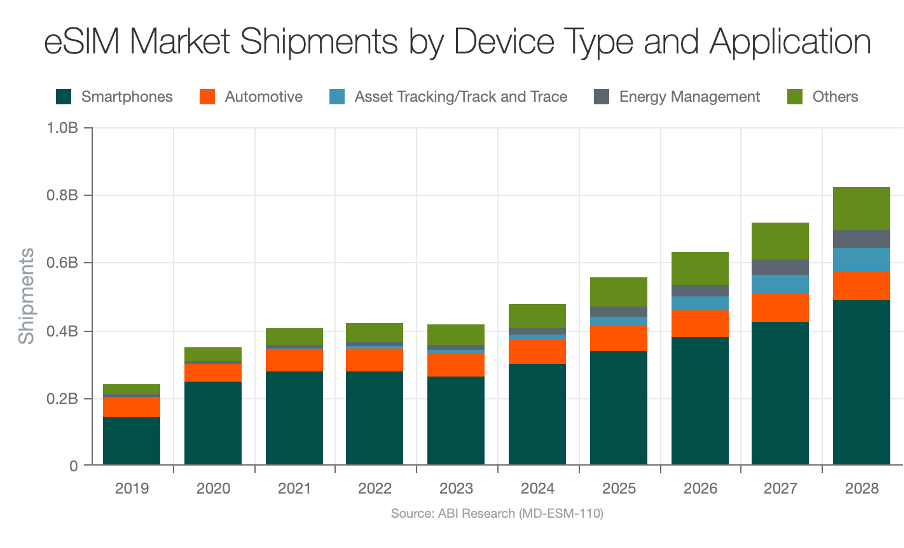

Global Device Shipment Trends

The shipment of eSIM-compatible smartphones and other consumer devices continues to rise rapidly. In 2022, estimates indicate that between 350 million and 382 million eSIM-capable devices were shipped, with TCA estimating a total available market of 427 million units. Of these, approximately 293 million were smartphones.

By 2023, global eSIM-compatible device shipments reached 439.5 million, bringing the total number of available eSIM devices to 986 million. In 2024, shipment volumes surpassed half a billion units, growing by 35% year-on-year to reach 503 million. The total available market for eSIM in 2024 was estimated at 514 million units.

Looking ahead, projections for 2027 forecast 3.5 billion devices leveraging eSIM technology. By 2030, global xSIM-capable device shipments will exceed 9 billion units, with a 22% CAGR from 2024 to 2030.

Source: Mobilise, based on ABI Research

Source: Mobilise, based on ABI Research

Future Projections and Penetration Rates

Projections suggest that by 2025, 60% of all smartphone unit sales will be eSIM-compatible. By 2030, nearly 70% of all cellular devices are expected to support eSIM technology. Annual shipments are projected to reach 880.6 million devices in 2028, with consumer eSIMs accounting for 67% of overall shipments – approximately 590 million units.

Estimates from Statista are even more optimistic, predicting that by 2030, 14 billion devices – or 82% of all smartphone shipments – will be eSIM-capable. However, this forecast likely includes IoT devices and other sensors that may be excluded from other reports.

Demand for eSIM-enabled devices is projected to reach 16 billion devices by 2030, a staggering 1354.5% increase from 2024. According to Juniper Research, there were around 1.1 billion active eSIM devices and sensors in 2024.

Simultaneously, there has been a stark decline in smartphones with single SIM card slots as eSIM enables dual SIM functionality. However, it’s estimated that the total available market for ‘traditional’ SIM remained stable at 3.7 billion units in 2024.

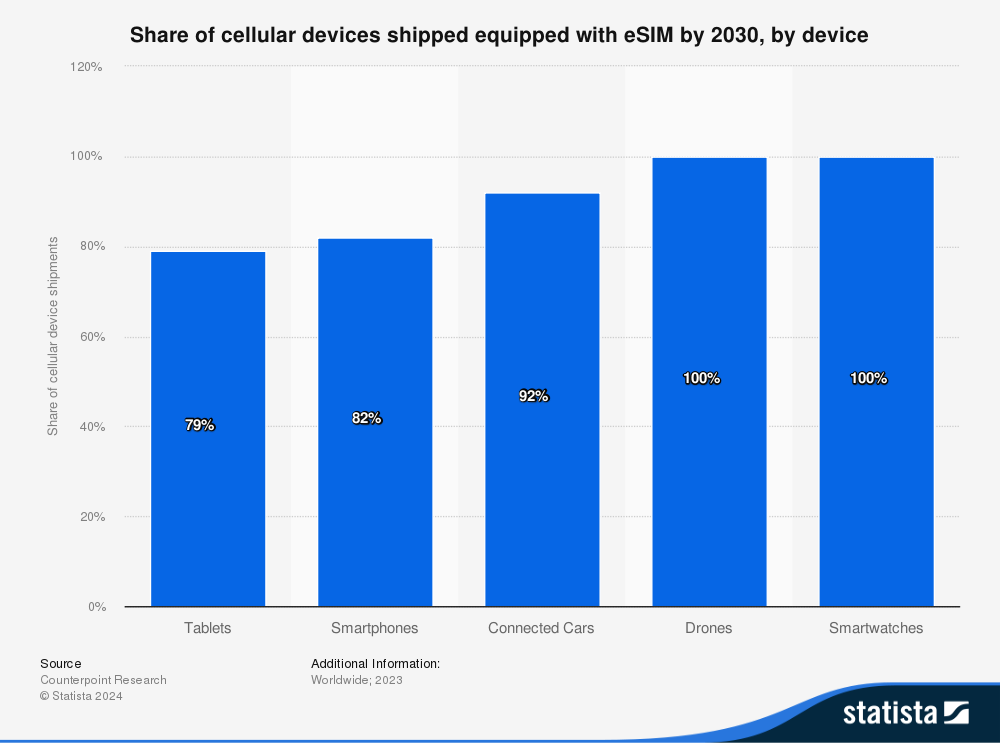

eSIM in Other Devices

eSIM is rapidly expanding beyond smartphones to include smartwatches, laptops, tablets, and drones. Adoption across these categories is accelerating, driven by the demand for enhanced connectivity and flexibility.

Source: Statista

Source: Statista

Smartwatches are leading the charge, with the global eSIM smartwatch market projected to grow from USD 2.8 billion in 2023 to USD 10.1 billion by 2032 at a CAGR of 15.3%. By 2025, 99% of smartwatches are expected to be eSIM-compatible, with full adoption anticipated by 2030. Apple remains the dominant player in this segment, continuing to drive eSIM adoption with its popular Apple Watch models.

Laptops are also experiencing significant growth in eSIM adoption, particularly among professionals and remote workers. According to Mobilise research, major brands like HP, Dell, Lenovo, Acer, Microsoft, and Asus now offer eSIM-compatible models. By 2025, 73% of laptops are expected to support eSIM, driven by demand for always-on connectivity, particularly for remote work, travel, and enhanced security.

Source: Mobilise, eSIM Laptops

Source: Mobilise, eSIM Laptops

Tablets are following suit, with Apple’s eSIM-compatible iPads leading the segment since the iPad Pro (3rd generation) in 2018. Tablets that support eSIM provide seamless access to cellular networks, appealing to professionals, travellers, and students who need reliable connectivity.

Drones are also embracing eSIM, with predictions indicating that 100% of drones will be eSIM-compatible by 2030. eSIM functionality in drones offers advantages such as real-time data transmission, improved GPS accuracy, and enhanced control capabilities, which are especially valuable for industrial applications like surveying, mapping, and logistics.

Source: ABI Research

Source: ABI Research

The rapid adoption of eSIM across these devices highlights its growing importance beyond smartphones. As prices for eSIM-compatible devices continue to drop and manufacturers expand their offerings, widespread adoption across all categories is inevitable.

Click here for a downloadable PDF to view all the statistics we’ve compiled in this blog!

eSIM Awareness and Adoption by Consumers

Despite significant technological advancements, consumer awareness and adoption of eSIM technology have lagged behind the industry’s potential. The eSIM landscape presents a chicken-and-egg scenario where operators hesitate to launch eSIM services due to low consumer awareness. In contrast, consumers depend on operators and OEMs to promote new technologies. This cycle has slowed down adoption, but recent developments are beginning to change the landscape.

Awareness Trends and Regional Variations

Consumer awareness of eSIM technology has been steadily improving, rising from 20% in 2020 to 50% in 2025. This growth has been partly driven by Apple’s launch of two eSIM-only iPhones in the US, which boosted awareness not only in North America but also globally. However, awareness remains inconsistent across regions and demographics.

Source: Mobilise, based on GSMA Intelligence

Source: Mobilise, based on GSMA Intelligence

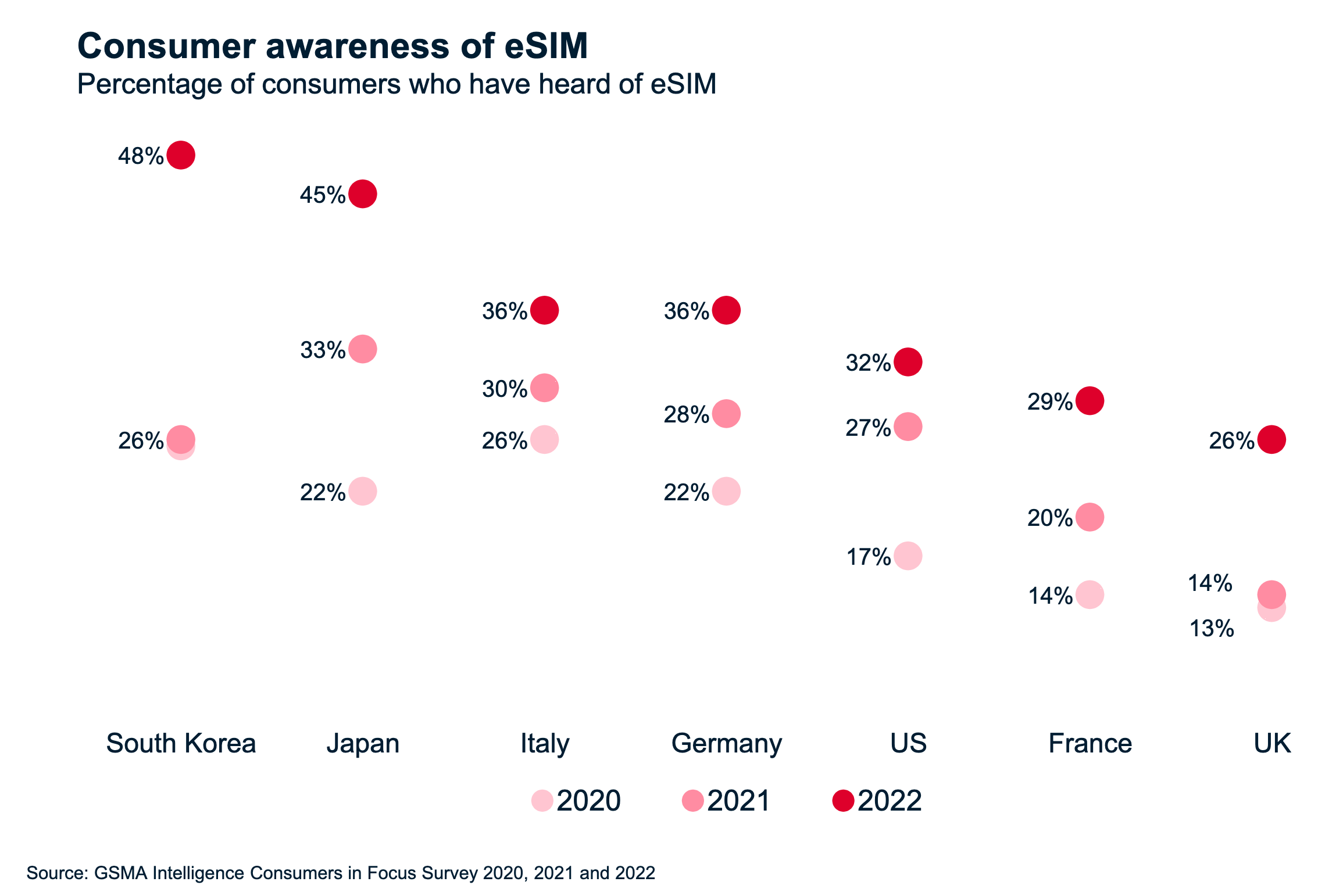

According to GSMA, awareness ranged from 26% in the UK to 48% in South Korea in 2022, with younger generations more likely to be familiar with eSIM technology (48% among 18-34-year-olds, 41% among 35-54-year-olds, and 25% among those aged 55 and above). Meanwhile, a Statista study reported that 58% of consumers in the US, UK, and Australia were aware of eSIM, likely reflecting higher adoption rates in these regions.

Source: GSMA Intelligence

Source: GSMA Intelligence

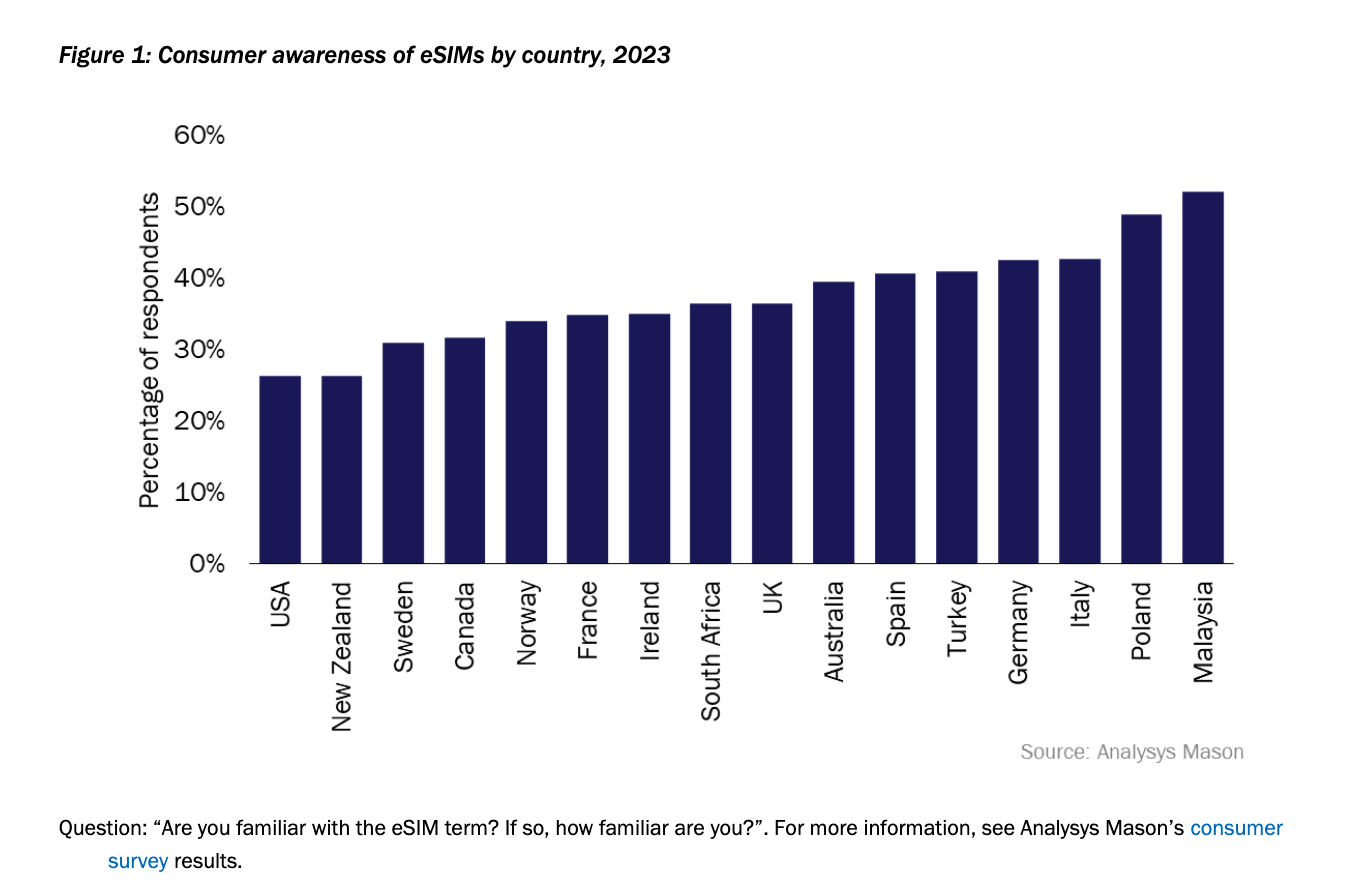

Source: Analysis Mason

Source: Analysis Mason

Despite this progress, many consumers remain unaware of their devices’ eSIM capabilities. A 2022 report found that while only 32% of smartphone users believed their devices were eSIM-enabled, 74% actually supported the technology.

Sources of Information and Marketing Gaps

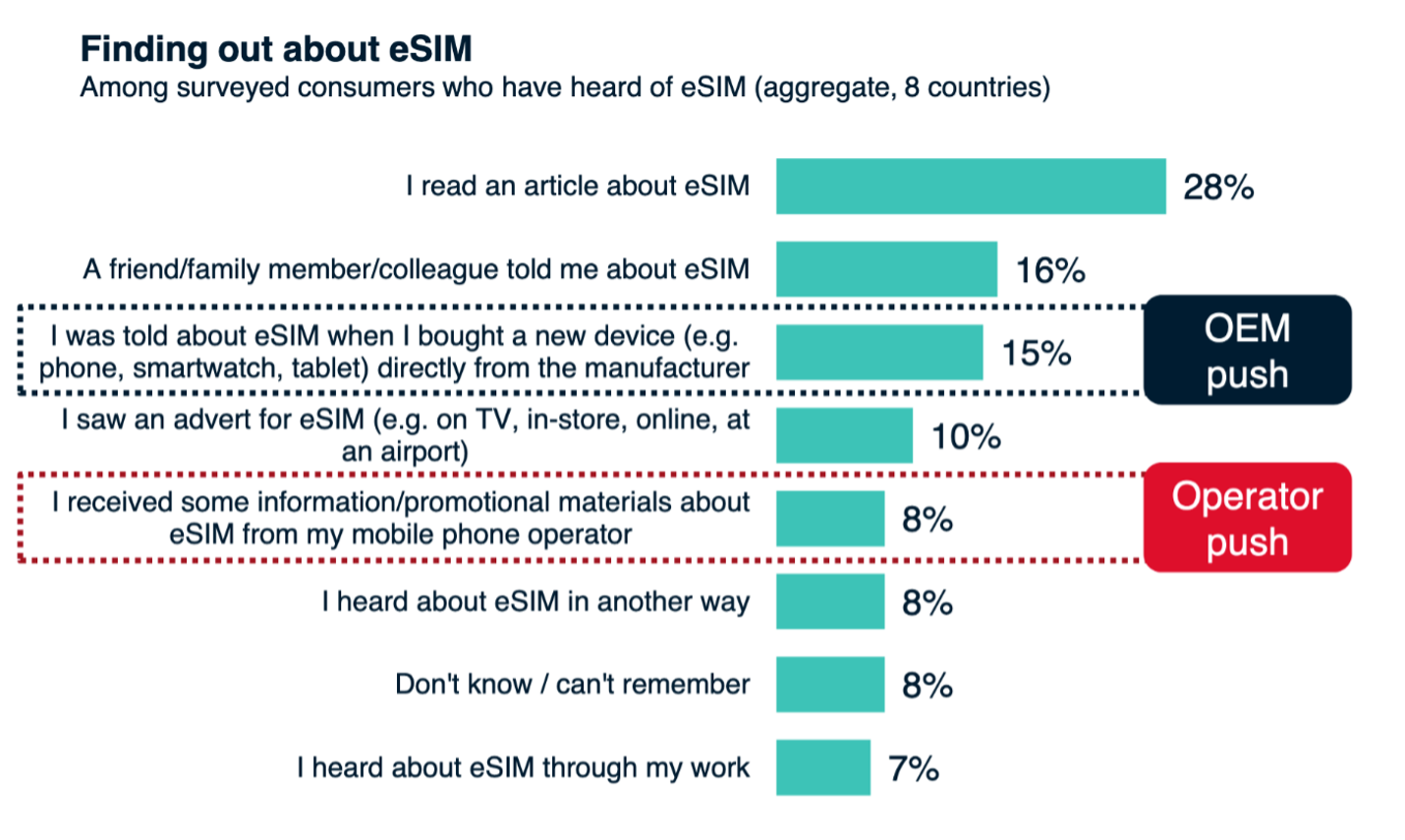

(Un)surprisingly, MNOs have done little to promote eSIM to consumers. Only 8% of eSIM-aware consumers discovered the technology via operator channels. Instead, more people learn about eSIM from articles (28%), word-of-mouth (16%), or smartphone manufacturers (15%).

Source: GSMA Intelligence

Source: GSMA Intelligence

Despite these gaps, interest in eSIM among non-users is high, with 54% expressing a willingness to adopt the technology. However, actual usage remains low, with only 19% of eSIM-aware consumers actively using eSIM.

The disconnect between consumer awareness and adoption suggests that operators and OEMs have not effectively communicated the benefits of eSIM technology to their customers.

Adoption Trends and Future Growth

While consumer awareness has grown, actual usage remains limited. LightReading noted that fewer than 1% of eSIM-equipped smartphones were actively using the technology in 2022, highlighting a significant gap between device capability and user adoption.

Nonetheless, adoption is expected to accelerate. According to Juniper Research, the global number of eSIM users will increase from 40 million in 2024 to an estimated 215 million by 2028. Furthermore, TCA reported a 130% surge in eSIM profile downloads in 2022, driven by the release of the eSIM-only iPhone 14.

By 2030, eSIM smartphone connections are predicted to reach an average of 77% across all key regions, with 98% adoption in North America, 95% in Europe, and 90% in China. The lowest adoption rates are expected in Sub-Saharan Africa (55%), India (65%), and CIS (68%).

Consumer Preferences and Use Cases

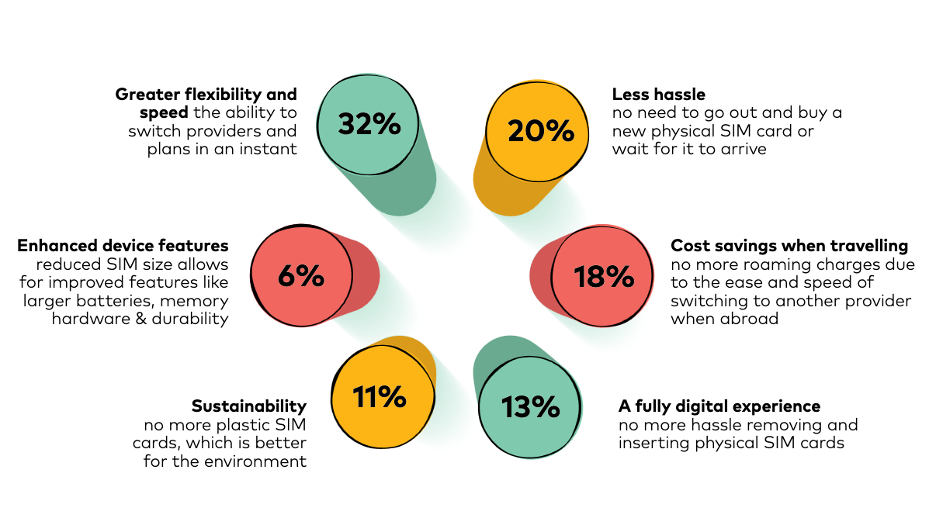

Consumers appreciate eSIMs for their flexibility and speed (32%), reduced hassle (20%), and cost savings while travelling (18%). As international travel increases from 1.3 billion in 2024 to 1.6 billion in 2028, the popularity of eSIMs for travel is expected to grow.

Source: Amdocs

Source: Amdocs

Despite growing interest, there is still confusion about eSIM technology’s availability and benefits. A 2023 survey revealed that less than 50% of respondents in most countries have heard of eSIMs or understand what they are used for. Surprisingly, this percentage drops to as low as 26% in the USA, despite it being the only country with an eSIM-only iPhone.

Click here for a downloadable PDF to view all the statistics we’ve compiled in this blog!

Environmental Impact of eSIM

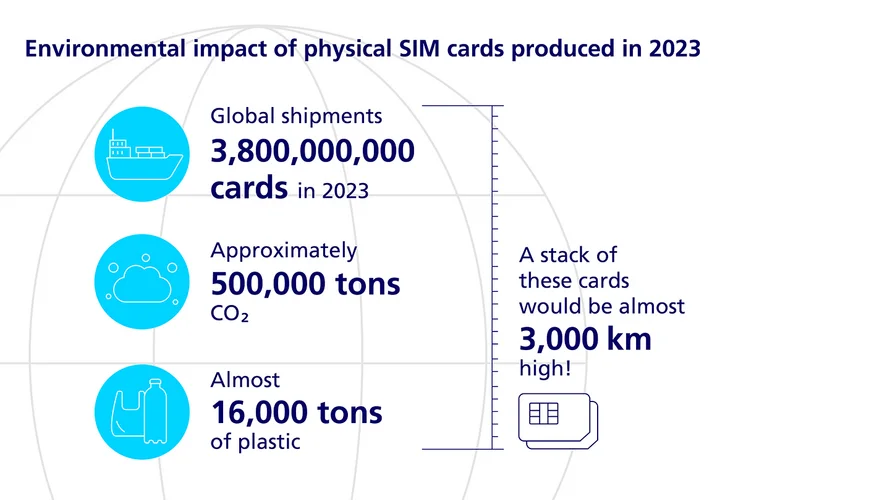

The adoption of eSIM technology offers a significant opportunity to reduce the environmental impact associated with traditional SIM cards. According to a 2012 ICMA estimate, global shipments of SIM cards were approximately 2 billion annually, each contributing around 35 grams of CO2e. This equated to about 70,000 tons of CO2e emissions per year. However, with mobile subscribers and SIM card shipments having more than doubled to 4.5 billion in 2024, annual emissions have soared to over 140,000 tons of CO2e.

Source: Fraunhofer Institute for Reliability and Microintegration

Source: Fraunhofer Institute for Reliability and Microintegration

A study by the Fraunhofer Institute for Reliability and Microintegration found that a traditional plastic SIM card generates 229 grams of CO2e over a three-year lifespan, which is 46% more than an eSIM’s 123 grams of CO2e. Furthermore, around 60% of the emissions from traditional SIM cards come from production and distribution logistics. In contrast, eSIMs contribute only about 2% of emissions during this phase, primarily due to computing power and energy consumption related to QR code transmission. The elimination of physical components and packaging in eSIM technology also reduces the environmental impact throughout the device’s lifecycle.

Unlike traditional SIM cards, which are often encased in plastic holders up to eight times larger than the SIM itself, eSIMs are directly soldered into devices. This eliminates the need for additional plastic, packaging, and transportation, drastically reducing associated carbon emissions. With eSIMs becoming integral components of smartphones, tablets, laptops, and other connected devices, their potential to contribute to sustainability efforts is substantial.

Source: G+D

Source: G+D

Consumer interest in sustainability is also growing, with 11% of consumers now considering it an important factor in their connectivity decisions. As environmental consciousness continues to rise, the preference for eSIM technology over traditional SIM cards is expected to grow, aligning with broader industry efforts to reduce carbon footprints.

The reduced carbon footprint, decreased plastic use, and improved efficiency of eSIM technology make it a crucial step toward enhancing sustainability within the telecom industry. As adoption accelerates, its environmental benefits will become even more pronounced, supporting the industry’s efforts to meet climate targets and reduce ecological impact.

Click here for a downloadable PDF to view all the statistics we’ve compiled in this blog!

Statistics

Consumer eSIM Market Size & Growth Statistics

- The consumer-focused eSIM market was valued at approximately USD 1.22 billion in 2023 and is expected to reach USD 6.29 billion by 2030, growing at a CAGR of 20% from 2024 to 2032. Fortune Business Insights

- eSIM Market Size in 2021: USD 7.3 billion. Straits Research

- eSIM Market Size in 2022: USD 8.34 billion. Straits Research

- eSIM Market Size in 2023: USD 11.76 billion in 2023. Globe Newswire

- eSIM Market Size in 2024: USD 13.54 billion in 2024. Globe Newswire

- eSIM Market Size in 2030: According to previous estimates, the market was projected to reach USD 17.5 billion by 2030 (Straits Research). However, according to the most recent report, the market is projected to reach USD 31.82 billion by 2030 (Globe Newswire), increasing the projections by nearly 82% between 2024 and 2025 (Mobilise).

- Connected cars/automotive segment held the largest share in 2023, accounting for 24.2% of the market. Fortune Business Insights

- Annual eSIM card shipments in the automotive industry are expected to approach 1 million by 2028, a nearly sevenfold increase over 2023. ABI Research

- Consumer electronics, especially wearables like smartwatches and smart glasses, are projected to grow at a CAGR of 27.9% from 2023 to 2028. The Business Research Company

- The smartphone and tablet segment is expected to be the fastest growing segment in the eSIM market segmented by application, at a CAGR of 8% during the 2023-2028 period. (The Business Research Company)

- Connectivity services dominated the consumer eSIM market, accounting for 88.6% or approximately USD 4.2 billion of the total market in 2023. This segment is expected to grow at a CAGR of 25.7% from 2023 to 2028. The Business Research Company

- In 2021, there were 1.2 billion eSIM connections across smartphones, smartwatches, laptops, and tablets. GSMA

- In 2025, the total number of eSIM connections is estimated to reach 3.4 billion. GSMA Intelligence

- 2025: 25% (low adoption) to 40% (high adoption) of smartphone connections are expected to use eSIM technology. GSMA Intelligence

- Smartphone Connections Using eSIM in 2022: 144 million eSIM smartphone connections. GSMA Intelligence

- Smartphone Connections Using eSIM in 2023: 310 million eSIM smartphone connections. GSMA Intelligence

- Smartphone Connections Using eSIM in 2024: 598 million eSIM smartphone connections. GSMA Intelligence

- Smartphone Connections Using eSIM in 2025: 1 billion eSIM smartphone connections (GSMA Intelligence), almost 18% up (Mobilise) from 850 million estimated by the GSMA in 2022.

- Smartphone eSIM connections double every year (2023-2025). Mobilise

- Smartphone eSIM connections increased by 594% between 2022 and 2025.

- 2028: 50% of all smartphone connections are estimated to use eSIM technology. GSMA Intelligence

- 2030: baseline scenario: 76% of smartphone connections (6.9 billion devices), low adoption scenario: 61% of smartphone connections (5.6 billion devices), high adoption scenario: 88% of smartphone connections (8 billion devices). GSMA Intelligence

Global eSIM Market Growth and Regional Dynamics Statistics

- 2019 to 2020: 24 new countries adopted eSIM (54% increase). Mobilise, based on GSMA Intelligence

- 2020 to 2021: 12 new countries adopted eSIM (17% increase). Mobilise, based on GSMA Intelligence

- 2021 to 2022: 19 new countries adopted eSIM (23% increase). Mobilise, based on GSMA Intelligence

- 2022 to 2023: 16 new countries adopted eSIM (16% increase). Mobilise, based on GSMA Intelligence

- 2023 to 2024: 7 new countries adopted eSIM (6% increase). Mobilise, based on GSMA Intelligence

- 2018 to 2024: 413% increase. Mobilise, based on GSMA Intelligence

North America

- 2024 market share: between 35% (MRA) and 40.2% (imarc) of the global eSIM market share.

- The United States accounted for 82% of North America’s eSIM market revenue in 2024. imarc

- North America’s eSIM market is expected to grow at a CAGR of 8.7% from 2025 to 2032. SkyQuest

Europe

32. The European eSIM market generated a revenue of USD 2.57 billion in 2023. Grand View Research

33. The European eSIM market is expected to grow at a CAGR of 8.3% from 2024 to 2030. Grand View Research

34. The United Kingdom, Germany, and France emerged as the primary revenue-generating nations in Europe in 2021. SkyQuest

35. France is expected to be the fastest-growing eSIM market globally over the next several years. SkyQuest

Source: SkyQuest

36. Italy is projected to register the highest CAGR in Europe from 2024 to 2030. Grand View Research

Asia-Pacific

- The Asia-Pacific region is the fastest-growing eSIM market globally, driven by rising consumer demand across India, South Korea, Japan, and China. GSMA Intelligence

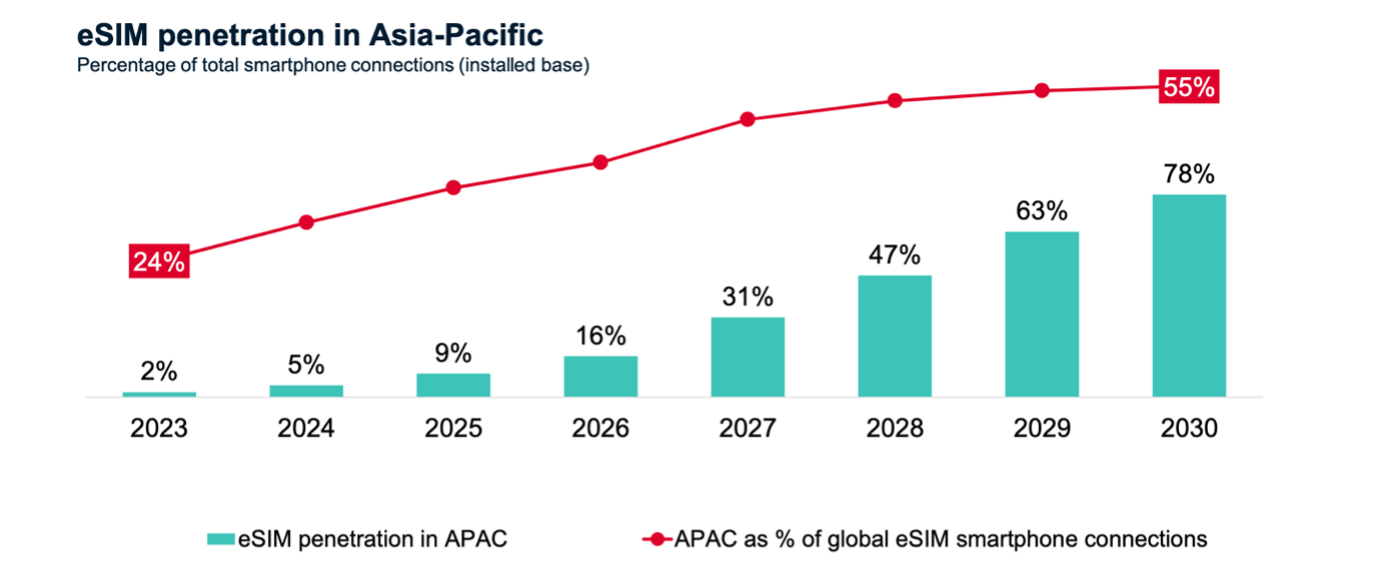

- In 2025, APAC has approximately 9% eSIM penetration rate. GSMA Intelligence

- eSIM penetration in APAC is expected to increase dramatically from 2% in 2023 to 78% in 2030. GSMA Intelligence

- APAC’s percentage of global smartphone connections will rise from 24% in 2023 to 55% in 2030. GSMA Intelligence

- China is expected to become the largest eSIM market in the world by 2030, with 1.5 billion eSIM connections. GSMA Intelligence

Latin America, Middle East & Africa

- Most of the 20 new eSIM-supporting countries in 2023 were countries from Africa.

- Argentina is expected to register the highest CAGR from 2024 to 2030 in Latin America. Grand View Research

eSIM Adoption by Mobile Operators Statistics

- In 2018, 2 years after the introduction of eSIM to the consumer market, only 45 operators around the world had offered commercial eSIM services. GSMA

- As of June 2024, 441 operators worldwide support eSIM, including MNOs, MVNOs, and international roaming services. GSMA Intelligence

- Between 2019 and 2021, the operator adoption of consumer eSIM increased by 125%. Mobilise, based on GSMA

- Between 2021 and 2023, the operator adoption of consumer eSIM increased by over 72%. Mobilise, based on GSMA

- The peak of eSIM adoption by operators occurred in 2022, with 111 new operators launching consumer eSIM offerings. Mobilise, based on GSMA Intelligence

- 90% of operators were expected to launch eSIM offerings by 2025, with momentum expected to peak between 2021 and 2022. GSMA Intelligence

- The United States has the highest eSIM penetration globally, with around 30% of consumers using eSIM technology. GSMA Intelligence

- Data shows that the launch of eSIM-only iPhones in the US had no measurable impact on consumer churn. GSMA Intelligence

- Traditional carriers could face up to $11 billion in lost roaming revenue due to consumers shifting to digital-first providers.

eSIM in the Travel Sector Statistics

- Retail spending on travel eSIM services is expected to grow by 500% between 2023 and 2028. Kaleido Intelligence

- Global travel eSIM market value is projected to reach $10 billion by 2028, representing over 80% of the entire travel SIM expenditure. Kaleido Intelligence

- Projected retail spending on travel connectivity services is expected to exceed $30 billion by 2028. Kaleido Intelligence

- The average spend per trip is $16 for travel eSIMs compared to $41 for traditional roaming services. Kaleido Intelligence

- 9 in 10 travellers are willing to use travel eSIMs if provided the option. Mobilise Travel Survey 2023

- In 2022, Brits accumulated over £539 million ($673 million) in unexpected roaming charges. Uswitch

- Significant growth in travel eSIM adoption has been observed in India, Brazil, the UAE, Australia, Malaysia, and Singapore. Kaleido Intelligence

- Hong Kong, Malaysia, China, and Singapore lead in the physical travel SIM purchases. Kaleido Intelligence

- 71% of Millennials and 69% of Gen Z are likely to consider purchasing a travel eSIM. Mobilise Travel Survey 2023

- 63% of Gen Z travellers are interested in buying data from travel operators such as airlines or booking sites. Mobilise Travel Survey 2023

- 22% of travellers opt not to use mobile data abroad, relying solely on public Wi-Fi or staying disconnected. Mobilise Travel Survey 2023

- Over 50% of users seek alternatives to roaming when costs reach $3-5 per day.

- 70% of silent roamers are likely to adopt travel eSIMs if available. Kaleido Intelligence

- 75% of travellers secure travel SIM or eSIM connectivity before their trip. Kaleido Intelligence

- About 60% of travellers would use roaming if it were cheaper. Kaleido Intelligence

- 27% of travellers are unsure about using their travel operator to purchase mobile connectivity. Mobilise Travel Survey 2023

OEM & Device Support Statistics

- eSIM technology was launched in 2010 for the IoT market and approved for consumer devices in 2016. Mobilise, eSIM history

- Google released the first eSIM-capable smartphone, the Pixel 2, in 2017. Mobilise, eSIM History

- Apple introduced eSIM support in the iPhone XR and iPhone XS in 2018. Mobilise, eSIM History

- Motorola launched the first eSIM-only smartphone, the Motorola RAZR, in 2019. Mobilise, eSIM History

- Apple launched the eSIM-only iPhone 14 in the US in 2022, followed by iPhone 15 and iPhone 16 in 2023 and 2024, respectively. Mobilise, eSIM History

- The iPhone 17 is expected to be the first eSIM-only model available globally in September 2025. MacRumors

- The most affordable eSIM-compatible smartphone is priced at approximately $200 in 2025. Mobilise, Most Affordable eSIM Smartphone

- In 2021, over 80% of manufacturers planned to adopt eSIMs by 2025, but by April 2025, only 25 brands (10%) had adopted eSIM technology. GSMA Intelligence

- eSIM-compatible smartphone models grew from 169 in April 2024 to 226 in April 2025, reflecting a 33% YoY increase. Mobilise, eSIM Statistics

- Top OEMs in 2025: Samsung (40 models), Apple (29 models), Motorola (28 models). Mobilise, eSIM Statistics

- OEMs with the Highest Model Growth (2024-2025): Samsung (+10 models), Motorola (+8 models), Vivo (+8 models), Xiaomi (+5 models), and Apple (+5 models).

- New OEMs in the eSIM Market (2024-2025): Asus (3 devices), Nothing Tech (1 device), TCL (1 device). Mobilise, eSIM Statistics

- eSIM device shipments in 2022 were estimated to be between 350 million and 382 million, with a total market of 427 million units. SkyQuestt, TCA

- Smartphone share of eSIM shipments in 2022 was approximately 293 million units. ABI Research

- The total available eSIM devices in 2023 reached 439.5 million, with a total of 986 million devices in the market. TechCabal

- In 2024, eSIM device shipments exceeded half a billion units, growing 35% year-on-year to reach 503 million. TCA

- In 2024, the total market for eSIM devices was estimated at 514 million units. TCA

- The total available market for traditional SIMs remained stable at 3.7 billion units in 2024. TCA

- 5 billion devices will be leveraging eSIM technology by 2027. TechCabal

- xSIM-capable device shipments are projected to exceed 9 billion units by 2030, with a 22% CAGR from 2024 to 2030. Counterpoint

- 60% of all smartphone unit sales are expected to be eSIM-compatible by 2025. GSMA Intelligence

- Nearly 70% of all cellular devices are expected to support eSIM technology by 2030. Amdocs, LightReading.

- Annual shipments of eSIM devices are expected to reach 880.6 million devices by 2028, with consumer eSIMs making up 67% of shipments (~590 million units). ABI Research, Mobilise, eSIM Statistics

- By 2030, 14 billion devices are projected to be eSIM-compatible, and this will account for 82% of all smartphone shipments. Statista

- Projected eSIM device demand by 2030 is estimated at 16 billion devices, a 1354.5% increase from 2024. Juniper Research, Mobilise, eSIM Statistics

- The smartwatch eSIM market is projected to grow from USD 2.8 billion in 2023 to USD 10.1 billion by 2032 (CAGR of 15.3%). DataIntelo

- By 2025, 99% of smartwatches are expected to be eSIM-compatible. Amdocs

- By 2030, smartwatches and drones are projected to be 100% eSIM-compatible. Statista

- 73% of laptops are expected to support eSIM by 2025. Mobilise, eSIM Laptops

Consumer eSIM Awareness & Adoption Statistics

- eSIM awareness in 2020: 20%.

- eSIM awareness in 2022: 30%.

- eSIM awareness in 2023: 36%.

- eSIM awareness in 2025: 50%.

- Awareness by region in 2022 varied between 26% in the UK and 48% in South Korea. GSMA

- Awareness by age group: 48% among 18–34-year-olds, 41% for 35-54-year-olds, 25% for 55 and above. GSMA

- Awareness in developed markets: 58% of US, UK, and Australian consumers are aware of eSIM. Statista

- 54% of non-users are interested in adopting eSIM. GSMA

- There was a 130% surge in eSIM profile downloads in 2022. TCA

- eSIM users are projected to grow from 40 million in 2024 to 215 million by 2028. Juniper Research

- In 2030, eSIM adoption is projected to average 77% globally, with 98% adoption in North America, 95% in Europe, and 90% in China. GSMA

- Less than 1% of eSIM-equipped smartphones actively used eSIM technology in 2022. LightReading

- 19% of eSIM-aware consumers actively use eSIM. eSIM Summit, MWC Barcelona 2025

Environmental Impact of eSIM Statistics

- 2012 SIM card shipments, estimated at 2 billion units, contributed to approximately 35 grams of CO2e per card. ICMA

- The total 2012 SIM card CO2e emissions added up to 70,000 tons. Mobilise, Sustainability in Telecommunication Industry

- Annual SIM card shipments in 2024 were estimated at 4.5 billion SIM cards annually, resulting in over 140,000 tonnes of CO2e emissions. Mobilise, Sustainability in the Telecommunication Industry

- A traditional SIM card has a footprint of 229 grams of CO2e over a three-year lifespan. Fraunhofer Institute

- An eSIM has a footprint of 123g of CO2e over a three-year lifespan. Fraunhofer Institute

- The carbon footprint of eSIM is 46% lower than traditional SIM. Mobilise, base on Fraunhofer Institute

- 60% of plastic SIM emissions stem from production and logistics. Fraunhofer Institute

- 2% of eSIM emissions stem from production and logistics. They come from computing power and energy related to QR code transmission. Fraunhofer Institute

- 11% of consumers consider sustainability an important factor in their decision-making. Amdocs

Conclusion

The rise of eSIM technology has been a focal point in recent years, and the industry is now on the cusp of a significant transformation.

With 2025 anticipated as the period of mass adoption, eSIM is poised to revolutionise the telecom sector as part of the broader move towards digitalisation. eSIMs offer substantial benefits, from enhanced flexibility to improved sustainability, signalling a major shift in how telecom services are delivered. The statistics discussed in this blog underscore the compelling future of eSIM technology.

If you require assistance with eSIM, our HERO® Platform is a digital-first platform that accelerates access to eSIM capabilities. This service helps mobile operators gain a competitive edge and diversify their value propositions, all while cutting costs, reducing timelines, and minimising project risks. Click here to contact us now or to schedule a demo!

If you haven’t yet, click here to view a downloadable PDF of all the statistics we’ve compiled in this blog!