Given that it is the 3rd Quarter reporting period, we thought it might be interesting to publish a series of posts over the coming days to shed a little light on the recent performance of some of our beloved MVNOs.

First cab off the rank, US-based Comcast xfinity mobile:

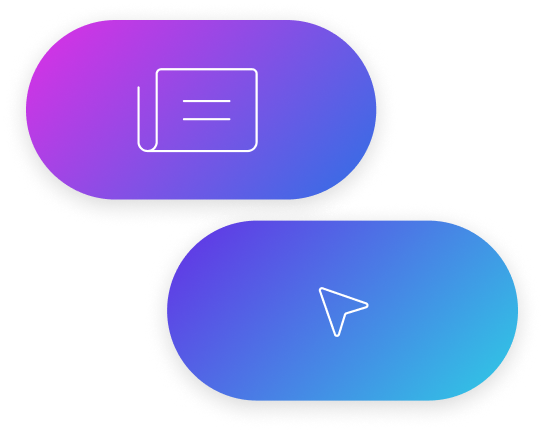

Comcast xfinity added 204,000 customers in Q319, to take its total wireless base to 1.7m. A good result but what is noticeable is that the pace of growth is slowing with the last three quarters showing a consistent decline in new activations of >10%. It’s becoming increasingly clear that Comcast’s wireless offering is simply playing a supporting role to residential broadband, which has performed well recently. The obvious strategy with wireless was always to create a stickier offering, and extend Customer Lifetime Value (CLV) for their residential broadband service, but at what cost?

Chart: @WaltLightShed Sep-19 Source: Company reports; LightShed

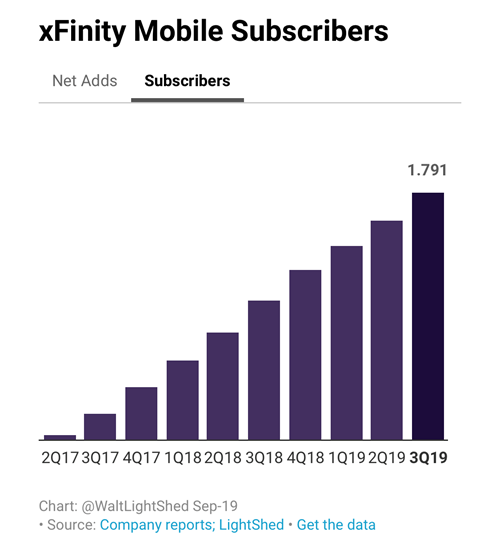

It’s been 9 quarters since Comcast launched its wireless product and there are no signs that it can break-even anytime soon as its Quarter on Quarter EBITDA losses continue. Q3 saw a loss of -$91m taking cumulative reported EBITDA losses since launch to a total of $1.5 billion. In the MVNO world, that is an astonishing amount of cash burn in just over 2 years. There were some minor improvements on monthly churn which was 1.5% versus 0.5%, but this delta would have had a negligible impact on overall bottom line.

No doubt there has also been an uplift in device sales in the quarter, with the launch of the iPhone 11. This would have had an incremental drain on working capital but made the service revenues and EBITDA look healthier, given the favourable accounting treatment of devices across the life of the customer plan. So considering this device revenue, and accounting treatment, in actual fact the loss is probably worse than it appears. There were also reports recently that Comcast and Charter were forced by Apple to purchase adjacent device types like Apple Watch and iPad, along with adopting considerable subsidies with its device pricing in order to acquire the new iPhone device ranges. This will likely also have an ongoing effect on cashflow and the balance sheet if stock doesn’t move or is sold below cost (which is often the case when the expectation is the airtime will cover the loss in the device).

Chart: @WaltLightShed Sep-19 Source: Company reports; LightShed

Looking at the graph above, it appears that Comcast has taken measures to reign in its losses around Q218, where a reduction in quarterly burn starts to be seen. It has been widely rumoured that the underlying wholesale airtime deal to Verizon is expensive, particularly on data rates. That being the case, the challenge Charter finds itself in is that while the industry is trending towards increasing data consumption and at the same time retail prices are declining, under a static unit based wholesale pricing model, each additional Gb consumed makes the unit economics for Charter’s wireless subs worse and worse as consumption grows. Compounding this issue is that the afore mentioned trends are set to continue for the foreseeable future and will only be made worse by the introduction of high speed 5G services. Without the appropriate levers in their wholesale deal, such as dynamic pricing based on volume or pricing review triggers based on retail market movements, this wholesale data cost is likely to be the most fundamental challenge in Comcast turning a profit in its wireless business in the future.

What also wouldn’t help is that Charter are entering into long term customer contracts which they will need to honour, regardless of how unprofitable they become as data consumption increases over time. This theme also aligns to much of the discussion coming from Charter around WiFi offload and CBRS deployment. The aim with this strategy is to take traffic from the relatively expensive Verizon network to a lower cost access network and improve overall cost per Gb.

Reports suggest that Charter is sending c80% of data traffic over WiFi and 6% of this is over public or semi-public xfinity WiFi hotspots, which, from our analysis, seems on the lower side. Perhaps indicating some improvements could be made to user experience or QoS.

The intent with wireless for Charter was always to create a stickier offering for its fixed broadband service, (see some of our insights on the value of bundling in telecoms in our previous post). So although these numbers don’t look great for a standalone wireless business the real question, which these figures do not answer alone, is what incremental value is Charter seeing generated back to its core residential broadband product as a result of these wireless connections? If, for example, an existing Charter broadband customer decides to renew a highly profitable 24 month fixed broadband contract because they also receive wireless then the real question becomes, what is the net incremental margin being generated by that customer to Comcast as a whole? A simplified calculation is Wireless CLV (negative) + Broadband CLV = Net Margin. If this number is in the black, then happy days and from a consolidated perspective the overall picture is a positive one for Charter. In this light and from a group P&L perspective, Wireless could almost be viewed as another marketing or SAC expense for the Broadband business.

That’s all for now punters, don’t forget your Halloween costumes this week….I’ll likely dress up but really I’m just in it for the sweets ???

Come back and visit us over the coming days for our results insights on giffgaff and Virgin Mobile UK.